Instructions For Form Mi-W4 - Michigan Withholding Exemption Certificate

ADVERTISEMENT

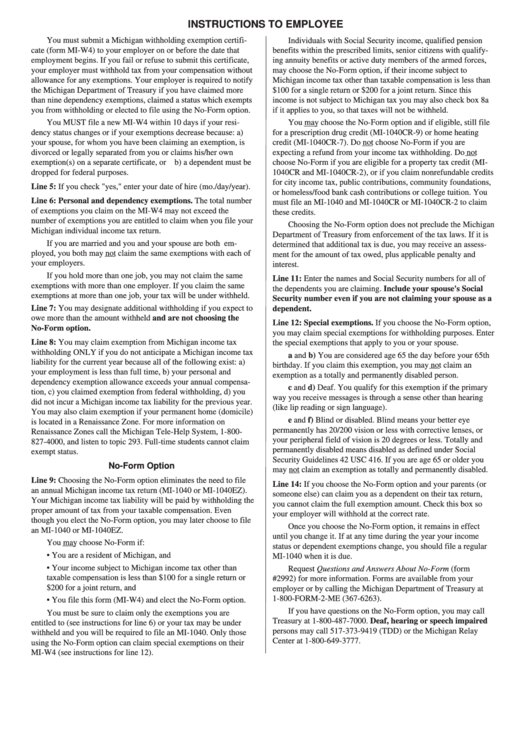

INSTRUCTIONS TO EMPLOYEE

You must submit a Michigan withholding exemption certifi-

Individuals with Social Security income, qualified pension

cate (form MI-W4) to your employer on or before the date that

benefits within the prescribed limits, senior citizens with qualify-

employment begins. If you fail or refuse to submit this certificate,

ing annuity benefits or active duty members of the armed forces,

your employer must withhold tax from your compensation without

may choose the No-Form option, if their income subject to

allowance for any exemptions. Your employer is required to notify

Michigan income tax other than taxable compensation is less than

the Michigan Department of Treasury if you have claimed more

$100 for a single return or $200 for a joint return. Since this

than nine dependency exemptions, claimed a status which exempts

income is not subject to Michigan tax you may also check box 8a

you from withholding or elected to file using the No-Form option.

if it applies to you, so that taxes will not be withheld.

You MUST file a new MI-W4 within 10 days if your resi-

You may choose the No-Form option and if eligible, still file

dency status changes or if your exemptions decrease because: a)

for a prescription drug credit (MI-1040CR-9) or home heating

your spouse, for whom you have been claiming an exemption, is

credit (MI-1040CR-7). Do not choose No-Form if you are

divorced or legally separated from you or claims his/her own

expecting a refund from your income tax withholding. Do not

exemption(s) on a separate certificate, or b) a dependent must be

choose No-Form if you are eligible for a property tax credit (MI-

dropped for federal purposes.

1040CR and MI-1040CR-2), or if you claim nonrefundable credits

for city income tax, public contributions, community foundations,

Line 5: If you check "yes," enter your date of hire (mo./day/year).

or homeless/food bank cash contributions or college tuition. You

Line 6: Personal and dependency exemptions. The total number

must file an MI-1040 and MI-1040CR or MI-1040CR-2 to claim

of exemptions you claim on the MI-W4 may not exceed the

these credits.

number of exemptions you are entitled to claim when you file your

Choosing the No-Form option does not preclude the Michigan

Michigan individual income tax return.

Department of Treasury from enforcement of the tax laws. If it is

If you are married and you and your spouse are both em-

determined that additional tax is due, you may receive an assess-

ployed, you both may not claim the same exemptions with each of

ment for the amount of tax owed, plus applicable penalty and

your employers.

interest.

If you hold more than one job, you may not claim the same

Line 11: Enter the names and Social Security numbers for all of

exemptions with more than one employer. If you claim the same

the dependents you are claiming. Include your spouse's Social

exemptions at more than one job, your tax will be under withheld.

Security number even if you are not claiming your spouse as a

Line 7: You may designate additional withholding if you expect to

dependent.

owe more than the amount withheld and are not choosing the

Line 12: Special exemptions. If you choose the No-Form option,

No-Form option.

you may claim special exemptions for withholding purposes. Enter

Line 8: You may claim exemption from Michigan income tax

the special exemptions that apply to you or your spouse.

withholding ONLY if you do not anticipate a Michigan income tax

a and b) You are considered age 65 the day before your 65th

liability for the current year because all of the following exist: a)

birthday. If you claim this exemption, you may not claim an

your employment is less than full time, b) your personal and

exemption as a totally and permanently disabled person.

dependency exemption allowance exceeds your annual compensa-

c and d) Deaf. You qualify for this exemption if the primary

tion, c) you claimed exemption from federal withholding, d) you

way you receive messages is through a sense other than hearing

did not incur a Michigan income tax liability for the previous year.

(like lip reading or sign language).

You may also claim exemption if your permanent home (domicile)

e and f) Blind or disabled. Blind means your better eye

is located in a Renaissance Zone. For more information on

permanently has 20/200 vision or less with corrective lenses, or

Renaissance Zones call the Michigan Tele-Help System, 1-800-

your peripheral field of vision is 20 degrees or less. Totally and

827-4000, and listen to topic 293. Full-time students cannot claim

permanently disabled means disabled as defined under Social

exempt status.

Security Guidelines 42 USC 416. If you are age 65 or older you

No-Form Option

may not claim an exemption as totally and permanently disabled.

Line 9: Choosing the No-Form option eliminates the need to file

Line 14: If you choose the No-Form option and your parents (or

an annual Michigan income tax return (MI-1040 or MI-1040EZ).

someone else) can claim you as a dependent on their tax return,

Your Michigan income tax liability will be paid by withholding the

you cannot claim the full exemption amount. Check this box so

proper amount of tax from your taxable compensation. Even

your employer will withhold at the correct rate.

though you elect the No-Form option, you may later choose to file

Once you choose the No-Form option, it remains in effect

an MI-1040 or MI-1040EZ.

until you change it. If at any time during the year your income

You may choose No-Form if:

status or dependent exemptions change, you should file a regular

• You are a resident of Michigan, and

MI-1040 when it is due.

• Your income subject to Michigan income tax other than

Request Questions and Answers About No-Form (form

taxable compensation is less than $100 for a single return or

#2992) for more information. Forms are available from your

$200 for a joint return, and

employer or by calling the Michigan Department of Treasury at

1-800-FORM-2-ME (367-6263).

• You file this form (MI-W4) and elect the No-Form option.

If you have questions on the No-Form option, you may call

You must be sure to claim only the exemptions you are

Treasury at 1-800-487-7000. Deaf, hearing or speech impaired

entitled to (see instructions for line 6) or your tax may be under

persons may call 517-373-9419 (TDD) or the Michigan Relay

withheld and you will be required to file an MI-1040. Only those

Center at 1-800-649-3777.

using the No-Form option can claim special exemptions on their

MI-W4 (see instructions for line 12).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1