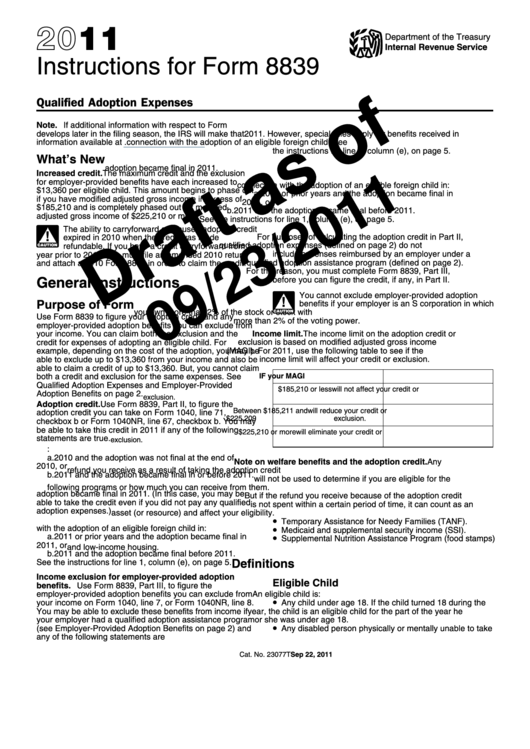

Instructions For Form 8839 Draft - Qualified Adoption Expenses - 2011

ADVERTISEMENT

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form 8839

Qualified Adoption Expenses

Note. If additional information with respect to Form 8839

1. You received employer-provided adoption benefits in

develops later in the filing season, the IRS will make that

2011. However, special rules apply for benefits received in

information available at

connection with the adoption of an eligible foreign child. See

the instructions for line 1, column (e), on page 5.

What’s New

2. You adopted a child with special needs and the

adoption became final in 2011.

Increased credit. The maximum credit and the exclusion

3. You received employer-provided adoption benefits in

for employer-provided benefits have each increased to

connection with the adoption of an eligible foreign child in:

$13,360 per eligible child. This amount begins to phase out

a. 2011 or prior years and the adoption became final in

if you have modified adjusted gross income in excess of

2011, or

$185,210 and is completely phased out for modified

b. 2011 and the adoption became final before 2011.

adjusted gross income of $225,210 or more.

See the instructions for line 1, column (e), on page 5.

The ability to carryforward an unused adoption credit

!

For purposes of calculating the adoption credit in Part II,

expired in 2010 when the credit was made

qualified adoption expenses (defined on page 2) do not

refundable. If you have a credit carryforward from a

CAUTION

include expenses reimbursed by an employer under a

year prior to 2010, you must file an amended 2010 return

qualified adoption assistance program (defined on page 2).

and attach a 2010 Form 8839 in order to claim the credit.

For this reason, you must complete Form 8839, Part III,

General Instructions

before you can figure the credit, if any, in Part II.

You cannot exclude employer-provided adoption

Purpose of Form

!

benefits if your employer is an S corporation in which

you own more than 2% of the stock or stock with

CAUTION

Use Form 8839 to figure your adoption credit and any

more than 2% of the voting power.

employer-provided adoption benefits you can exclude from

Income limit. The income limit on the adoption credit or

your income. You can claim both the exclusion and the

credit for expenses of adopting an eligible child. For

exclusion is based on modified adjusted gross income

(MAGI). For 2011, use the following table to see if the

example, depending on the cost of the adoption, you may be

income limit will affect your credit or exclusion.

able to exclude up to $13,360 from your income and also be

able to claim a credit of up to $13,360. But, you cannot claim

IF your MAGI is...

THEN the income limit...

both a credit and exclusion for the same expenses. See

Qualified Adoption Expenses and Employer-Provided

$185,210 or less

will not affect your credit or

Adoption Benefits on page 2.

exclusion.

Adoption credit. Use Form 8839, Part II, to figure the

Between $185,211 and

will reduce your credit or

adoption credit you can take on Form 1040, line 71,

$225,209

exclusion.

checkbox b or Form 1040NR, line 67, checkbox b. You may

be able to take this credit in 2011 if any of the following

$225,210 or more

will eliminate your credit or

statements are true.

exclusion.

1. You paid qualified adoption expenses in:

a. 2010 and the adoption was not final at the end of

Note on welfare benefits and the adoption credit. Any

2010, or

refund you receive as a result of taking the adoption credit

b. 2011 and the adoption became final in or before 2011.

will not be used to determine if you are eligible for the

2. You adopted a child with special needs and the

following programs or how much you can receive from them.

adoption became final in 2011. (In this case, you may be

But if the refund you receive because of the adoption credit

able to take the credit even if you did not pay any qualified

is not spent within a certain period of time, it can count as an

adoption expenses.)

asset (or resource) and affect your eligibility.

•

3. You paid qualified adoption expenses in connection

Temporary Assistance for Needy Families (TANF).

•

with the adoption of an eligible foreign child in:

Medicaid and supplemental security income (SSI).

a. 2011 or prior years and the adoption became final in

•

Supplemental Nutrition Assistance Program (food stamps)

2011, or

and low-income housing.

b. 2011 and the adoption became final before 2011.

Definitions

See the instructions for line 1, column (e), on page 5.

Income exclusion for employer-provided adoption

Eligible Child

benefits. Use Form 8839, Part III, to figure the

employer-provided adoption benefits you can exclude from

An eligible child is:

•

your income on Form 1040, line 7, or Form 1040NR, line 8.

Any child under age 18. If the child turned 18 during the

You may be able to exclude these benefits from income if

year, the child is an eligible child for the part of the year he

your employer had a qualified adoption assistance program

or she was under age 18.

•

(see Employer-Provided Adoption Benefits on page 2) and

Any disabled person physically or mentally unable to take

any of the following statements are true.

care of himself or herself.

Sep 22, 2011

Cat. No. 23077T

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7