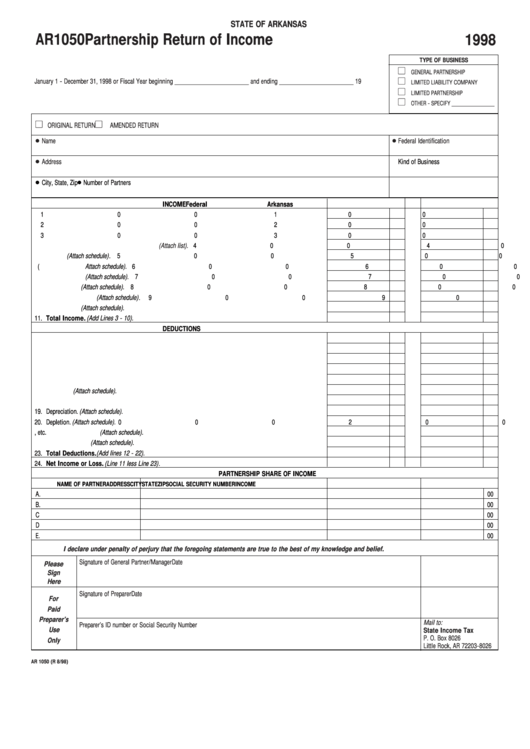

STATE OF ARKANSAS

AR1050

Partnership Return of Income

1998

TYPE OF BUSINESS

GENERAL PARTNERSHIP

January 1 - December 31, 1998 or Fiscal Year beginning _____________________ and ending _____________________ 19

LIMITED LIABILITY COMPANY

LIMITED PARTNERSHIP

OTHER - SPECIFY ______________

ORIGINAL RETURN

AMENDED RETURN

Name

Federal Identification

Address

Kind of Business

City, State, Zip

Number of Partners

INCOME

Federal

Arkansas

01. Gross receipts or sales. ...................................................................................................................................... 01

00

01

00

02. Cost of goods sold. ............................................................................................................................................ 02

00

02

00

03. Gross profit from business. ................................................................................................................................ 03

00

03

00

04. Income from other partnerships or fiduciaries.

(Attach list). ...............................................................................

04

00

04

00

05. Interest. (Attach schedule) . .................................................................................................................................. 05

00

05

00

06. Rental income. ( Attach schedule). ....................................................................................................................... 06

00

06

00

07. Royalty income. (Attach schedule). ..................................................................................................................... 07

00

07

00

08. Farm income. (Attach schedule). ........................................................................................................................ 08

00

08

00

09. Capital gain or loss. (Attach schedule) . ............................................................................................................. 09

00

09

00

10. Other income. (Attach schedule). ........................................................................................................................ 10

00

10

00

11. Total Income. (Add Lines 3 - 10). ................................................................................................................... 11

00

11

00

DEDUCTIONS

12. Salaries of employees. ........................................................................................................................................ 12

00

12

00

13. Guaranteed payments to partners......................................................................................................................... 13

00

13

00

14. Rent on business. ............................................................................................................................................... 14

00

14

00

15. Interest expense. ................................................................................................................................................. 15

00

15

00

16 Taxes.................................................................................................................................................................... 16

00

16

00

17. Bad debts. (Attach schedule). ............................................................................................................................... 17

00

17

00

18. Repairs. ............................................................................................................................................................... 18

00

18

00

19. Depreciation. (Attach schedule). ........................................................................................................................ 19

00

19

00

20. Depletion. (Attach schedule). .............................................................................................................................. 20

00

20

00

21. Retirement plans, etc. (Attach schedule). ............................................................................................................ 21

00

21

00

22. Other deductions. (Attach schedule). ................................................................................................................. 22

00

22

00

23. Total Deductions. (Add lines 12 - 22). ........................................................................................................... 23

00

23

00

24. Net Income or Loss. (Line 11 less Line 23) . ................................................................................................. 24

00

24

00

PARTNERSHIP SHARE OF INCOME

NAME OF PARTNER

ADDRESS

CITY

STATE

ZIP

SOCIAL SECURITY NUMBER

INCOME

A.

00

B.

00

C

00

D

00

E.

00

I declare under penalty of perjury that the foregoing statements are true to the best of my knowledge and belief.

Signature of General Partner/Manager

Date

Please

Sign

Here

Signature of Preparer

Date

For

Paid

Preparer’s

Mail to:

Preparer’s ID number or Social Security Number

Use

State Income Tax

P. O. Box 8026

Only

Little Rock, AR 72203-8026

AR 1050 (R 8/98)

1

1 2

2