-

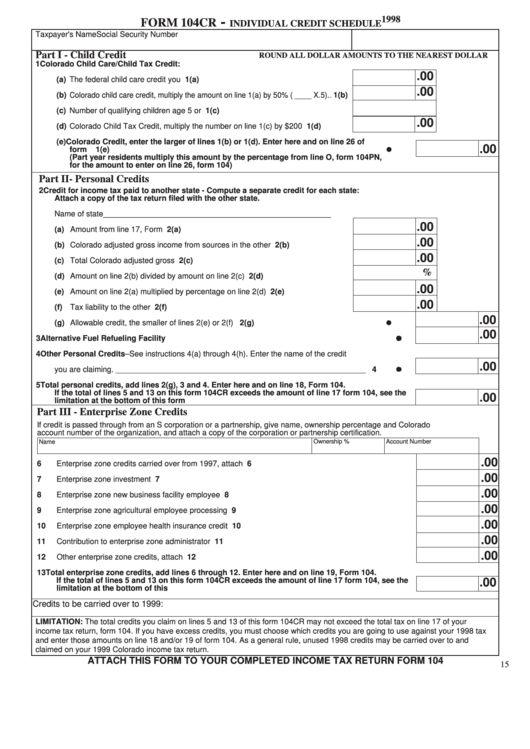

1998

FORM 104CR

INDIVIDUAL CREDIT SCHEDULE

Taxpayer's Name

Social Security Number

Part I - Child Credit

ROUND ALL DOLLAR AMOUNTS TO THE NEAREST DOLLAR

1

Colorado Child Care/Child Tax Credit:

.00

(a) The federal child care credit you claimed ........................................................ 1(a)

.00

(b) Colorado child care credit, multiply the amount on line 1(a) by 50% ( ____ X.5) .. 1(b)

(c) Number of qualifying children age 5 or under ................................................. 1(c)

.00

(d) Colorado Child Tax Credit, multiply the number on line 1(c) by $200 ............ 1(d)

(e) Colorado Credit, enter the larger of lines 1(b) or 1(d). Enter here and on line 26 of

.00

form 104 .................................................................................................................................

1(e)

(Part year residents multiply this amount by the percentage from line O, form 104PN,

for the amount to enter on line 26, form 104)

Part II- Personal Credits

2

Credit for income tax paid to another state - Compute a separate credit for each state:

Attach a copy of the tax return filed with the other state.

Name of state ____________________________________________________

.00

(a) Amount from line 17, Form 104 ....................................................................... 2(a)

.00

(b) Colorado adjusted gross income from sources in the other state .................. 2(b)

.00

(c) Total Colorado adjusted gross income ............................................................ 2(c)

%

(d) Amount on line 2(b) divided by amount on line 2(c) ....................................... 2(d)

.00

(e) Amount on line 2(a) multiplied by percentage on line 2(d) .............................. 2(e)

.00

(f) Tax liability to the other state ........................................................................... 2(f)

.00

(g) Allowable credit, the smaller of lines 2(e) or 2(f) .....................................................................

2(g)

.00

3

Alternative Fuel Refueling Facility Credit ......................................................................................

3

4

Other Personal Credits–See instructions 4(a) through 4(h). Enter the name of the credit

.00

you are claiming. _________________________________________________________ .............

4

5

Total personal credits, add lines 2(g), 3 and 4. Enter here and on line 18, Form 104.

If the total of lines 5 and 13 on this form 104CR exceeds the amount of line 17 form 104, see the

.00

limitation at the bottom of this form .................................................................................................... 5

Part III - Enterprise Zone Credits

If credit is passed through from an S corporation or a partnership, give name, ownership percentage and Colorado

account number of the organization, and attach a copy of the corporation or partnership certification.

Ownership %

Account Number

Name

.00

6

Enterprise zone credits carried over from 1997, attach schedule ........................................................... 6

.00

7

Enterprise zone investment credit ........................................................................................................... 7

.00

8

Enterprise zone new business facility employee credit ........................................................................... 8

.00

9

Enterprise zone agricultural employee processing credit ....................................................................... 9

.00

10

Enterprise zone employee health insurance credit ............................................................................... 10

.00

11

Contribution to enterprise zone administrator credit ............................................................................. 11

.00

12

Other enterprise zone credits, attach explanation ................................................................................ 12

13

Total enterprise zone credits, add lines 6 through 12. Enter here and on line 19, Form 104.

If the total of lines 5 and 13 on this form 104CR exceeds the amount of line 17 form 104, see the

.00

limitation at the bottom of this form .................................................................................................. 13

Credits to be carried over to 1999:

LIMITATION: The total credits you claim on lines 5 and 13 of this form 104CR may not exceed the total tax on line 17 of your

income tax return, form 104. If you have excess credits, you must choose which credits you are going to use against your 1998 tax

and enter those amounts on line 18 and/or 19 of form 104. As a general rule, unused 1998 credits may be carried over to and

claimed on your 1999 Colorado income tax return.

ATTACH THIS FORM TO YOUR COMPLETED INCOME TAX RETURN FORM 104

15

1

1