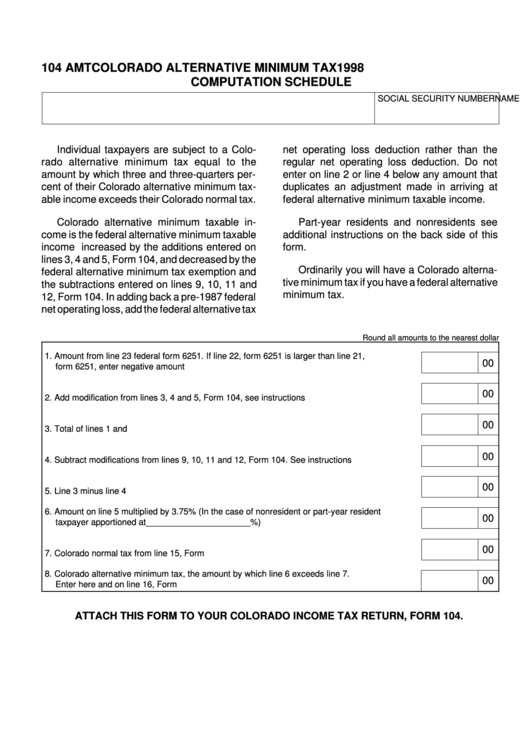

104 AMT

COLORADO ALTERNATIVE MINIMUM TAX

1998

COMPUTATION SCHEDULE

NAME

SOCIAL SECURITY NUMBER

Individual taxpayers are subject to a Colo-

net operating loss deduction rather than the

rado alternative minimum tax equal to the

regular net operating loss deduction. Do not

amount by which three and three-quarters per-

enter on line 2 or line 4 below any amount that

cent of their Colorado alternative minimum tax-

duplicates an adjustment made in arriving at

able income exceeds their Colorado normal tax.

federal alternative minimum taxable income.

Colorado alternative minimum taxable in-

Part-year residents and nonresidents see

come is the federal alternative minimum taxable

additional instructions on the back side of this

income increased by the additions entered on

form.

lines 3, 4 and 5, Form 104, and decreased by the

Ordinarily you will have a Colorado alterna-

federal alternative minimum tax exemption and

tive minimum tax if you have a federal alternative

the subtractions entered on lines 9, 10, 11 and

minimum tax.

12, Form 104. In adding back a pre-1987 federal

net operating loss, add the federal alternative tax

Round all amounts to the nearest dollar

1. Amount from line 23 federal form 6251. If line 22, form 6251 is larger than line 21,

00

form 6251, enter negative amount here ................................................................................... 1

00

2. Add modification from lines 3, 4 and 5, Form 104, see instructions above .............................. 2

00

3. Total of lines 1 and 2 ................................................................................................................ 3

00

4. Subtract modifications from lines 9, 10, 11 and 12, Form 104. See instructions above .......... 4

00

5. Line 3 minus line 4 ................................................................................................................... 5

6. Amount on line 5 multiplied by 3.75% (In the case of nonresident or part-year resident

00

taxpayer apportioned at______________________%) ........................................................... 6

00

7. Colorado normal tax from line 15, Form 104 ............................................................................ 7

8. Colorado alternative minimum tax, the amount by which line 6 exceeds line 7.

00

Enter here and on line 16, Form 104 ....................................................................................... 8

ATTACH THIS FORM TO YOUR COLORADO INCOME TAX RETURN, FORM 104.

1

1