Form Ir - South Lebanon Income Tax Return - 2011

ADVERTISEMENT

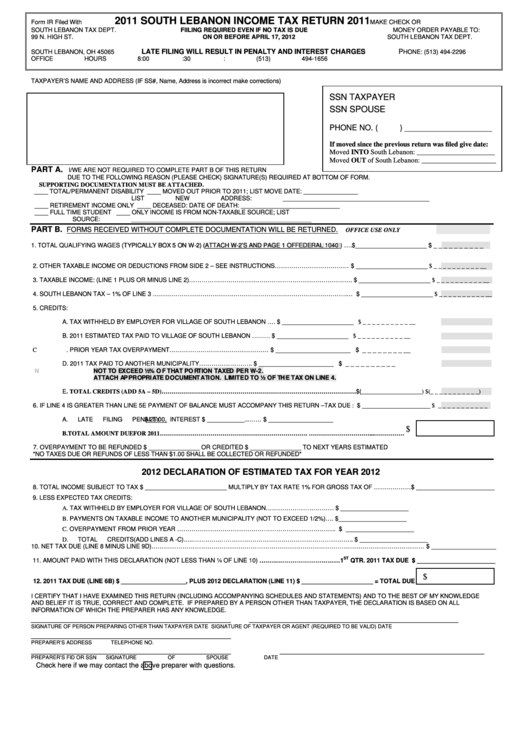

2011 SOUTH LEBANON INCOME TAX RETURN 2011

Form IR

Filed With

MAKE CHECK OR

SOUTH LEBANON TAX DEPT.

FIILING REQUIRED EVEN IF NO TAX IS DUE

MONEY ORDER PAYABLE TO:

99 N. HIGH ST.

ON OR BEFORE APRIL 17, 2012

SOUTH LEBANON TAX DEPT.

P.O. BOX 40

LATE FILING WILL RESULT IN PENALTY AND INTEREST CHARGES

P

SOUTH LEBANON, OH 45065

HONE: (513) 494-2296

OFFICE HOURS 8:00 A.M. to 4:30 P.M.

FAX: (513) 494-1656

TAXPAYER’S NAME AND ADDRESS (IF SS#, Name, Address is incorrect make corrections)

SSN TAXPAYER

SSN SPOUSE

PHONE NO. (

) ____________________

If moved since the previous return was filed give date:

Moved INTO South Lebanon: ______________________

Moved OUT of South Lebanon: _____________________

PART A.

I/WE ARE NOT REQUIRED TO COMPLETE PART B OF THIS RETURN

DUE TO THE FOLLOWING REASON (PLEASE CHECK) SIGNATURE(S) REQUIRED AT BOTTOM OF FORM.

SUPPORTING DOCUMENTATION MUST BE ATTACHED.

____ TOTAL/PERMANENT DISABILITY

____ MOVED OUT PRIOR TO 2011; LIST MOVE DATE: ________________

LIST NEW ADDRESS: ___________________________________________

____ RETIREMENT INCOME ONLY

____ DECEASED: DATE OF DEATH: _____________________________

____ FULL TIME STUDENT

____ ONLY INCOME IS FROM NON-TAXABLE SOURCE; LIST

SOURCE: _____________________________________________________

PART B.

FORMS RECEIVED WITHOUT COMPLETE DOCUMENTATION WILL BE RETURNED.

OFFICE USE ONLY

1. TOTAL QUALIFYING WAGES

(

T

Y

P

I

C

A

L

L

Y

B

O

X

5

O

N

W

-

2

)

(

ATTACH W-2’S AND PAGE 1 OF FEDERAL

1040)

) ….$_____________________

$ _ _ _ _ _ _ _ _ _ _

(

T

Y

P

I

C

A

L

L

Y

B

O

X

5

O

N

W

-

2

)

(

ATTACH W-2’S AND PAGE 1 OF FEDERAL 1040

2. OTHER TAXABLE INCOME OR DEDUCTIONS FROM SIDE 2 – SEE INSTRUCTIONS ……………………………… $ _____________________

$ _ _ _ _ _ _ _ _ _ _ __

3. TAXABLE INCOME: (LINE 1 PLUS OR MINUS LINE 2) ……………………………………………………………………. $ _____________________

$ _ _ _ _ _ _ _ _ _ _ __

4. SOUTH LEBANON TAX – 1% OF LINE 3 ………………………………………………………………………………….… $ _____________________

$ _ _ _ _ _ _ _ _ _ _ __

5. CREDITS:

A. TAX WITHHELD BY EMPLOYER FOR VILLAGE OF SOUTH LEBANON …. $ _____________________

$ _ _ _ _ _ _ _ _ _ _ __

B. 2011 ESTIMATED TAX PAID TO VILLAGE OF SOUTH LEBANON ………

$ _____________________

$ _ _ _ _ _ _ _ _ _ _ __

C. PRIOR YEAR TAX OVERPAYMENT…………………………………………

$ ______________________

$ _ _ _ _ _ _ _ _ __

D. 2011 TAX PAID TO ANOTHER MUNICIPALITY……………………..

$ ______________________

$ _ _ _ _ _ _ _ _ _ _

N

N

O

O

T

T

T

T

O

O

E

E

X

X

C

C

E

E

E

E

D

D

½

½

%

%

O

O

F

F

T

T

H

H

A

A

T

T

P

P

O

O

R

R

T

T

I

I

O

O

N

N

T

T

A

A

X

X

E

E

D

D

P

P

E

E

R

R

W

W

-

-

2

2

.

.

A

A

T

T

T

T

A

A

C

C

H

H

A

A

P

P

P

P

R

R

O

O

P

P

R

R

I

I

A

A

T

T

E

E

D

D

O

O

C

C

U

U

M

M

E

E

N

N

T

T

A

A

T

T

I

I

O

O

N

N

.

.

L

L

I

I

M

M

I

I

T

T

E

E

D

D

T

T

O

O

½

½

O

O

F

F

T

T

H

H

E

E

T

T

A

A

X

X

O

O

N

N

L

L

I

I

N

N

E

E

4

4

.

.

E. TOTAL CREDITS (ADD 5A – 5D)……………………………………………………………………………………$(____________________)

$(_ _ _ _ _ _ _ _ _ _ _)

6. IF LINE 4 IS GREATER THAN LINE 5E PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN –TAX DUE : $ ____________________

$ _ _ _ _ _ _ _ _ _ _ _

A.

LATE FILING PENALTY $ 25.00, INTEREST $ ___________.....................................……..TOTAL $ ___________________

$

B.

TOTAL AMOUNT DUE FOR 2011………………………………………………………………. …………………………...……………

7. OVERPAYMENT TO BE REFUNDED $ _______________ OR CREDITED $ _______________ TO NEXT YEARS ESTIMATED

*NO TAXES DUE OR REFUNDS OF LESS THAN $1.00 SHALL BE COLLECTED OR REFUNDED*

2012 DECLARATION OF ESTIMATED TAX FOR YEAR 2012

8. TOTAL INCOME SUBJECT TO TAX $ ________________________ MULTIPLY BY TAX RATE 1% FOR GROSS TAX OF ………………$ _______________________

9. LESS EXPECTED TAX CREDITS:

A.

TAX WITHHELD BY EMPLOYER FOR VILLAGE OF SOUTH LEBANON …………………………… $ ____________________

PAYMENTS ON TAXABLE INCOME TO ANOTHER MUNICIPALITY (NOT TO EXCEED 1/2%)…. $____________________

B.

C.

OVERPAYMENT FROM PRIOR YEAR ………………………………………………………………….. $ ____________________

TOTAL CREDITS (ADD LINES A -C)…..………….……………………………………………………….. $ ____________________

D.

10. NET TAX DUE (LINE 8 MINUS LINE 9D) …………………………………………………………………………………………………………………… $ ___________________

ST

11. AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN ¼ OF LINE 10) …………………………………1

QTR. 2011 TAX DUE $ _______________________

$

12. 2011 TAX DUE (LINE 6B) $ ___________________, PLUS 2012 DECLARATION (LINE 11) $ _____________________ = TOTAL DUE

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE

AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL

INFORMATION OF WHICH THE PREPARER HAS ANY KNOWLEDGE.

__________________________________________

____________________________________________

SIGNATURE OF PERSON PREPARING OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT (REQUIRED TO BE VALID)

DATE

__________________________________________

PREPARER’S ADDRESS

TELEPHONE NO.

__________________________________________

___________________________________________

PREPARER’S FID OR SSN

SIGNATURE OF SPOUSE

DATE

Check here if we may contact the above preparer with questions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2