Instructions For Form 568 - Limited Liability Company Return Of Income - 1998

ADVERTISEMENT

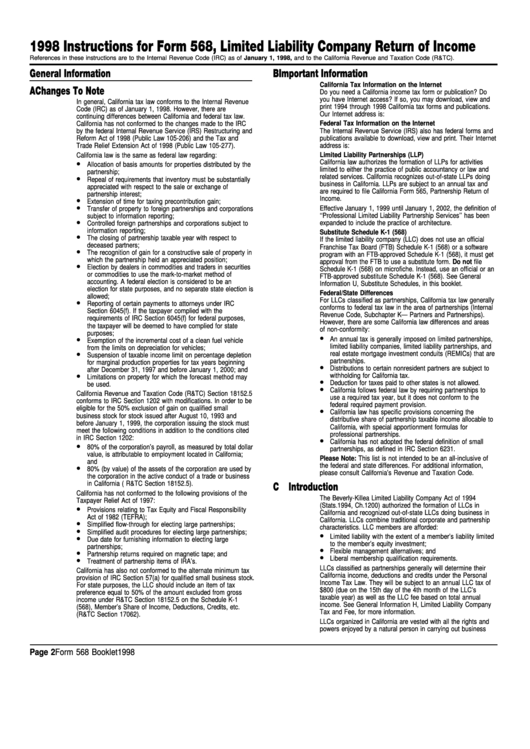

1998 Instructions for Form 568, Limited Liability Company Return of Income

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 1998, and to the California Revenue and Taxation Code (R&TC).

General Information

B Important Information

California Tax Information on the Internet

A Changes To Note

Do you need a California income tax form or publication? Do

you have Internet access? If so, you may download, view and

In general, California tax law conforms to the Internal Revenue

print 1994 through 1998 California tax forms and publications.

Code (IRC) as of January 1, 1998. However, there are

Our Internet address is:

continuing differences between California and federal tax law.

Federal Tax Information on the Internet

California has not conformed to the changes made to the IRC

The Internal Revenue Service (IRS) also has federal forms and

by the federal Internal Revenue Service (IRS) Restructuring and

Reform Act of 1998 (Public Law 105-206) and the Tax and

publications available to download, view and print. Their Internet

address is:

Trade Relief Extension Act of 1998 (Public Law 105-277).

Limited Liability Partnerships (LLP)

California law is the same as federal law regarding:

•

California law authorizes the formation of LLPs for activities

Allocation of basis amounts for properties distributed by the

limited to either the practice of public accountancy or law and

partnership;

•

related services. California recognizes out-of-state LLPs doing

Repeal of requirements that inventory must be substantially

business in California. LLPs are subject to an annual tax and

appreciated with respect to the sale or exchange of

are required to file California Form 565, Partnership Return of

partnership interest;

•

Income.

Extension of time for taxing precontribution gain;

•

Transfer of property to foreign partnerships and corporations

Effective January 1, 1999 until January 1, 2002, the definition of

‘‘Professional Limited Liability Partnership Services’’ has been

subject to information reporting;

•

expanded to include the practice of architecture.

Controlled foreign partnerships and corporations subject to

information reporting;

Substitute Schedule K-1 (568)

•

The closing of partnership taxable year with respect to

If the limited liability company (LLC) does not use an official

deceased partners;

Franchise Tax Board (FTB) Schedule K-1 (568) or a software

•

The recognition of gain for a constructive sale of property in

program with an FTB-approved Schedule K-1 (568), it must get

which the partnership held an appreciated position;

approval from the FTB to use a substitute form. Do not file

•

Election by dealers in commodities and traders in securities

Schedule K-1 (568) on microfiche. Instead, use an official or an

or commodities to use the mark-to-market method of

FTB-approved substitute Schedule K-1 (568). See General

accounting. A federal election is considered to be an

Information U, Substitute Schedules, in this booklet.

election for state purposes, and no separate state election is

Federal/State Differences

allowed;

•

For LLCs classified as partnerships, California tax law generally

Reporting of certain payments to attorneys under IRC

conforms to federal tax law in the area of partnerships (Internal

Section 6045(f). If the taxpayer complied with the

Revenue Code, Subchapter K — Partners and Partnerships).

requirements of IRC Section 6045(f) for federal purposes,

However, there are some California law differences and areas

the taxpayer will be deemed to have complied for state

of non-conformity:

purposes;

•

•

An annual tax is generally imposed on limited partnerships,

Exemption of the incremental cost of a clean fuel vehicle

limited liability companies, limited liability partnerships, and

from the limits on depreciation for vehicles;

•

real estate mortgage investment conduits (REMICs) that are

Suspension of taxable income limit on percentage depletion

partnerships.

for marginal production properties for tax years beginning

•

Distributions to certain nonresident partners are subject to

after December 31, 1997 and before January 1, 2000; and

•

withholding for California tax.

Limitations on property for which the forecast method may

•

Deduction for taxes paid to other states is not allowed.

be used.

•

California follows federal law by requiring partnerships to

California Revenue and Taxation Code (R&TC) Section 18152.5

use a required tax year, but it does not conform to the

conforms to IRC Section 1202 with modifications. In order to be

federal required payment provision.

eligible for the 50% exclusion of gain on qualified small

•

California law has specific provisions concerning the

business stock for stock issued after August 10, 1993 and

distributive share of partnership taxable income allocable to

before January 1, 1999, the corporation issuing the stock must

California, with special apportionment formulas for

meet the following conditions in addition to the conditions cited

professional partnerships.

in IRC Section 1202:

•

California has not adopted the federal definition of small

•

80% of the corporation’s payroll, as measured by total dollar

partnerships, as defined in IRC Section 6231.

value, is attributable to employment located in California;

Please Note: This list is not intended to be an all-inclusive of

and

•

the federal and state differences. For additional information,

80% (by value) of the assets of the corporation are used by

please consult California’s Revenue and Taxation Code.

the corporation in the active conduct of a trade or business

in California ( R&TC Section 18152.5).

C Introduction

California has not conformed to the following provisions of the

The Beverly-Killea Limited Liability Company Act of 1994

Taxpayer Relief Act of 1997:

(Stats.1994, Ch.1200) authorized the formation of LLCs in

•

Provisions relating to Tax Equity and Fiscal Responsibility

California and recognized out-of-state LLCs doing business in

Act of 1982 (TEFRA);

California. LLCs combine traditional corporate and partnership

•

Simplified flow-through for electing large partnerships;

characteristics. LLC members are afforded:

•

Simplified audit procedures for electing large partnerships;

•

•

Limited liability with the extent of a member’s liability limited

Due date for furnishing information to electing large

to the member’s equity investment;

partnerships;

•

•

Flexible management alternatives; and

Partnership returns required on magnetic tape; and

•

•

Liberal membership qualification requirements.

Treatment of partnership items of IRA’s.

LLCs classified as partnerships generally will determine their

California has also not conformed to the alternate minimum tax

California income, deductions and credits under the Personal

provision of IRC Section 57(a) for qualified small business stock.

Income Tax Law. They will be subject to an annual LLC tax of

For state purposes, the LLC should include an item of tax

$800 (due on the 15th day of the 4th month of the LLC’s

preference equal to 50% of the amount excluded from gross

taxable year) as well as the LLC fee based on total annual

income under R&TC Section 18152.5 on the Schedule K-1

income. See General Information H, Limited Liability Company

(568), Member’s Share of Income, Deductions, Credits, etc.

Tax and Fee, for more information.

(R&TC Section 17062).

LLCs organized in California are vested with all the rights and

powers enjoyed by a natural person in carrying out business

Page 2

Form 568 Booklet 1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13