Retaliatory Tax Calculation For Non-Domestic Legal Expense Organizations - Oregon Department Of Consumer And Business Services

ADVERTISEMENT

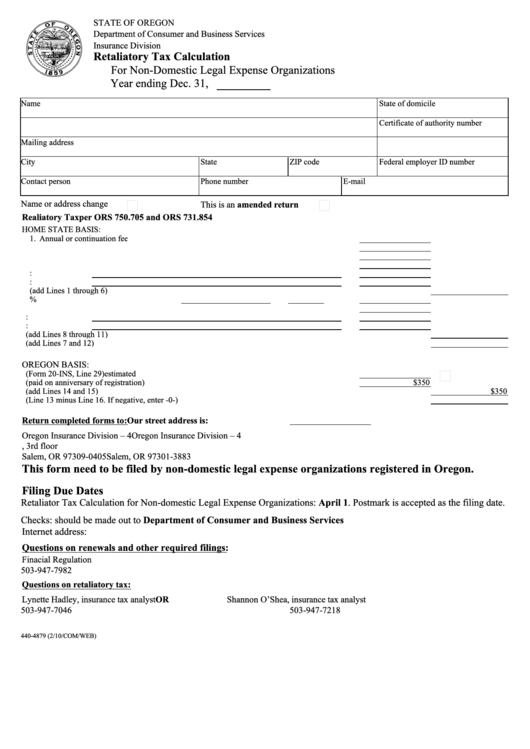

STATE OF OREGON

Department of Consumer and Business Services

Insurance Division

Retaliatory Tax Calculation

For Non-Domestic Legal Expense Organizations

Year ending Dec. 31,

Name

State of domicile

Certificate of authority number

Mailing address

City

State

ZIP code

Federal employer ID number

Contact person

Phone number

E-mail

Name or address change

This is an amended return

Realiatory Tax

per ORS 750.705 and ORS 731.854

HOME STATE BASIS:

1. Annual or continuation fee

2. Filing annual statement

3. Agent appointment fees paid by insurer

4. State fraud fees or assessments

5. Other fees:

6. Other fees:

7. Total fees (add Lines 1 through 6)

8. Premium or privilege tax

X

%

9. Income or excise tax

10. Other taxes:

11. Other taxes:

12. Total taxes (add Lines 8 through 11)

13. Total Home State Basis (add Lines 7 and 12)

OREGON BASIS:

14. Oregon Corporation Excise Tax (Form 20-INS, Line 29)

estimated

15. Certificate of Authority renewal fee (paid on anniversary of registration)

$350

16. Total Oregon Basis (add Lines 14 and 15)

$350

17. Retaliatory Tax (Line 13 minus Line 16. If negative, enter -0-)

Return completed forms to:

Our street address is:

Oregon Insurance Division – 4

Oregon Insurance Division – 4

P.O. Box 14480

350 Winter Street NE, 3rd floor

Salem, OR 97309-0405

Salem, OR 97301-3883

This form need to be filed by non-domestic legal expense organizations registered in Oregon.

Filing Due Dates

Retaliator Tax Calculation for Non-domestic Legal Expense Organizations: April 1. Postmark is accepted as the filing date.

Checks: should be made out to Department of Consumer and Business Services

Internet address: Blank forms are available on the Web site.

Questions on renewals and other required filings:

Finacial Regulation

503-947-7982

Questions on retaliatory tax:

Lynette Hadley, insurance tax analyst

OR

Shannon O’Shea, insurance tax analyst

503-947-7046

503-947-7218

lynette.m.hadley@state.or.us

shannon.oshea@state.or.us

440-4879 (2/10/COM/WEB)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1