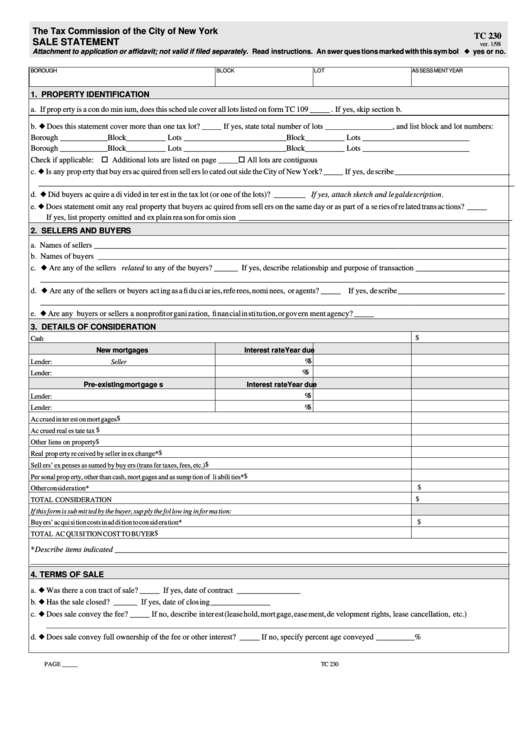

The Tax Com mis sion of the City of New York

TC 230

SALE STATEMENT

ver. 1/98

At tach ment to ap pli ca tion or affidavit; not valid if filed sepa rately. Read in struc tions. An swer ques tions marked with this sym bol u yes or no.

BOR OUGH

BLOCK

LOT

AS SESS MENT YEAR

1. PROP ERTY IDEN TI FI CA TION

a. If prop erty is a con do min ium, does this sched ule cover all lots listed on form TC 109 _____ . If yes, skip sec tion b.

b. u Does this state ment cover more than one tax lot? _____ If yes, state to tal number of lots _________________, and list block and lot num bers:

Bor ough ____________Block__________ Lots __________________________

Block__________ Lots ___________________________

Bor ough ____________Block__________ Lots __________________________

Block__________ Lots ___________________________

Check if ap pli ca ble: o Ad di tional lots are listed on page _____

o All lots are con tigu ous

c. u Is any prop erty that buy ers ac quired from sell ers lo cated out side the City of New York? _____ If yes, de scribe _____________________________

________________________________________________________________________________________________________________________

d. u Did buy ers ac quire a di vided in ter est in the tax lot (or one of the lots)? ________ If yes, at tach sketch and le gal de scrip tion.

e. u Does state ment omit any real prop erty that buy ers ac quired from sell ers on the same day or as part of a se ries of re lated trans ac tions? _____

If yes, list prop erty omit ted and ex plain rea son for omis sion _____________________________________________________________________

2. SELL ERS AND BUY ERS

a. Names of sell ers ________________________________________________________________________________________________________

b. Names of buy ers ________________________________________________________________________________________________________

c. u Are any of the sell ers re lated to any of the buy ers? ______ If yes, de scribe re la tion ship and pur pose of trans ac tion ________________________

______________________________________________________________________________________________________________________

d. u Are any of the sell ers or buy ers act ing as a fi du ci ar ies, refe rees, nomi nees, or agents? _____ If yes, de scribe ___________________________

______________________________________________________________________________________________________________________

e. u Are any buy ers or sell ers a non profit or gani za tion, fi nan cial in sti tu tion, or gov ern ment agency? _____

3. DE TAILS OF CON SID ERA TION

$

Cash

New mort gages

In ter est rate

Year due

%

$

Lender:

Seller

%

$

Lender:

Pre- existing mort gages

Interest rate

Year due

%

$

Lender:

Lender:

%

$

$

Ac crued in ter est on mort gages

$

Ac crued real es tate tax

$

Other liens on prop erty

$

Real prop erty re ceived by seller in ex change*

$

Sell ers’ ex penses as sumed by buy ers (trans fer taxes, fees, etc.)

$

Per sonal prop erty, other than cash, mort gages and as sump tion of li abili ties*

$

Other con sid era tion*

$

TO TAL CON SID ERA TION

If this form is sub mit ted by the buyer, sup ply the fol low ing in for ma tion:

$

Buy ers’ ac qui si tion costs in ad di tion to con sid era tion*

$

TO TAL AC QUI SI TION COST TO BUYER

*De scribe items in di cated ___________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

4. TERMS OF SALE

a. u Was there a con tract of sale? _____ If yes, date of con tract ________________

b. u Has the sale closed? ______ If yes, date of clos ing _______________

c. u Does sale con vey the fee? _____ If no, de scribe in ter est (lease hold, mort gage, ease ment, de vel op ment rights, lease can cel la tion, etc.)

____________________________________________________________________________________________________________________

d. u Does sale con vey full own er ship of the fee or other in ter est? _____ If no, spec ify per cent age con veyed __________%

PAGE _____

TC 230

1

1 2

2