Application For Exemption Certificate For Replacement Parts And/or Services For Farm Machinery And Equipment - State Of Washington

ADVERTISEMENT

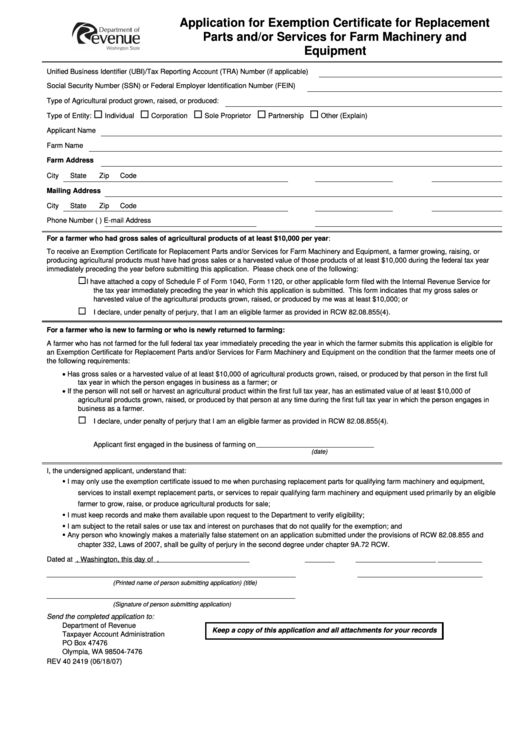

Application for Exemption Certificate for Replacement

Parts and/or Services for Farm Machinery and

Equipment

Unified Business Identifier (UBI)/Tax Reporting Account (TRA) Number (if applicable)

Social Security Number (SSN) or Federal Employer Identification Number (FEIN)

Type of Agricultural product grown, raised, or produced:

Type of Entity:

Individual

Corporation

Sole Proprietor

Partnership

Other (Explain)

Applicant Name

Farm Name

Farm Address

City

State

Zip Code

Mailing Address

City

State

Zip Code

Phone Number

(

)

E-mail Address

For a farmer who had gross sales of agricultural products of at least $10,000 per year:

To receive an Exemption Certificate for Replacement Parts and/or Services for Farm Machinery and Equipment, a farmer growing, raising, or

producing agricultural products must have had gross sales or a harvested value of those products of at least $10,000 during the federal tax year

immediately preceding the year before submitting this application. Please check one of the following:

I have attached a copy of Schedule F of Form 1040, Form 1120, or other applicable form filed with the Internal Revenue Service for

the tax year immediately preceding the year in which this application is submitted. This form indicates that my gross sales or

harvested value of the agricultural products grown, raised, or produced by me was at least $10,000; or

I declare, under penalty of perjury, that I am an eligible farmer as provided in RCW 82.08.855(4).

For a farmer who is new to farming or who is newly returned to farming:

A farmer who has not farmed for the full federal tax year immediately preceding the year in which the farmer submits this application is eligible for

an Exemption Certificate for Replacement Parts and/or Services for Farm Machinery and Equipment on the condition that the farmer meets one of

the following requirements:

•

Has gross sales or a harvested value of at least $10,000 of agricultural products grown, raised, or produced by that person in the first full

tax year in which the person engages in business as a farmer; or

•

If the person will not sell or harvest an agricultural product within the first full tax year, has an estimated value of at least $10,000 of

agricultural products grown, raised, or produced by that person at any time during the first full tax year in which the person engages in

business as a farmer.

I declare, under penalty of perjury that I am an eligible farmer as provided in RCW 82.08.855(4).

Applicant first engaged in the business of farming on

(date)

I, the undersigned applicant, understand that:

I may only use the exemption certificate issued to me when purchasing replacement parts for qualifying farm machinery and equipment,

services to install exempt replacement parts, or services to repair qualifying farm machinery and equipment used primarily by an eligible

farmer to grow, raise, or produce agricultural products for sale;

I must keep records and make them available upon request to the Department to verify eligibility;

I am subject to the retail sales or use tax and interest on purchases that do not qualify for the exemption; and

Any person who knowingly makes a materially false statement on an application submitted under the provisions of RCW 82.08.855 and

.

chapter 332, Laws of 2007, shall be guilty of perjury in the second degree under chapter 9A.72 RCW

Dated at

, Washington, this

day of

,

(Printed name of person submitting application)

(title)

(Signature of person submitting application)

Send the completed application to:

Department of Revenue

Keep a copy of this application and all attachments for your records

Taxpayer Account Administration

PO Box 47476

Olympia, WA 98504-7476

REV 40 2419 (06/18/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1