Form Ar1000-Co - Individual Income Tax Schedule Of Check-Off Contributions - 2012 Page 2

ADVERTISEMENT

INSTRUCTIONS FOR AR1000-CO

GENERAL INSTRUCTIONS:

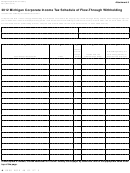

Check the appropriate box and enter the designated amount for each check-off contribution in the box

provided. Total your contributions and enter the amount in Box 10. Contributions are limited to

whole dollar amounts only.

SPECIAL INSTRUCTIONS FOR LINE 9:

A new check-off was added, beginning for tax year 2009, allowing contributions for up to two Arkansas

Tax Deferred Tuition Savings Program account(s). The account(s) must already be in existence at

the time you make your election. Enter type of account and account numbers for each account, or

your contribution will not be recognized.

FOR TAXPAYERS WHO ARE DUE A REFUND:

This schedule must be attached to any return claiming a check-off contribution. Enter the amount

in Box 10 on Line 47 of Form AR1000F/AR1000NR or Line 27 of Form AR1000S. The total amount

you contribute will reduce your refund by a corresponding amount.

If this schedule is not attached to your return or if the amount in Box 10 is not entered on your return,

your contribution will not be recognized and the amount will be refunded to you.

FOR TAXPAYERS WHO OWE ADDITIONAL TAXES:

Detach this schedule and submit a separate check for the total amount of your check-off contribu-

tions. (You can send a check for check-off contributions #1 through #8. You cannot send

a check for check-off contribution #9.) Mail to: Arkansas Individual Income Tax - Accounting

Branch, P.O. Box 3628, Little Rock, AR 72203.

AR1000-CO Instr. (R 9/27/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2