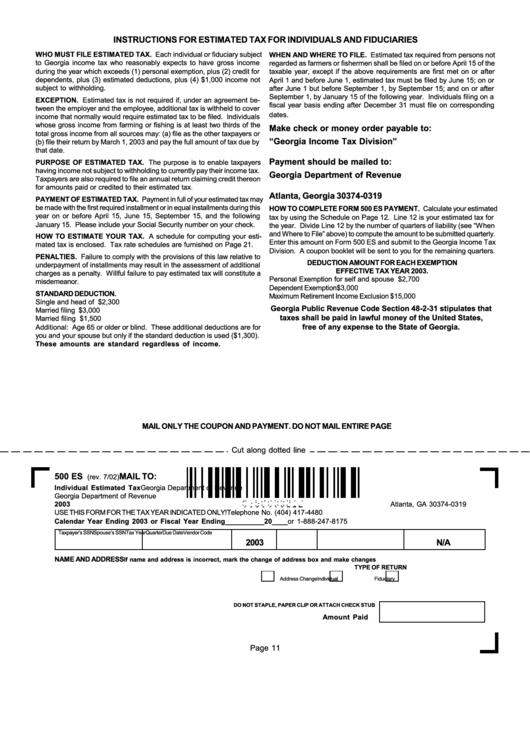

Form 500 Es - Individual Estimated Tax - 2003

ADVERTISEMENT

INSTRUCTIONS FOR ESTIMATED TAX FOR INDIVIDUALS AND FIDUCIARIES

WHO MUST FILE ESTIMATED TAX. Each individual or fiduciary subject

WHEN AND WHERE TO FILE. Estimated tax required from persons not

to Georgia income tax who reasonably expects to have gross income

regarded as farmers or fishermen shall be filed on or before April 15 of the

during the year which exceeds (1) personal exemption, plus (2) credit for

taxable year, except if the above requirements are first met on or after

dependents, plus (3) estimated deductions, plus (4) $1,000 income not

April 1 and before June 1, estimated tax must be filed by June 15; on or

subject to withholding.

after June 1 but before September 1, by September 15; and on or after

September 1, by January 15 of the following year. Individuals filing on a

EXCEPTION. Estimated tax is not required if, under an agreement be-

fiscal year basis ending after December 31 must file on corresponding

tween the employer and the employee, additional tax is withheld to cover

dates.

income that normally would require estimated tax to be filed. Individuals

whose gross income from farming or fishing is at least two thirds of the

Make check or money order payable to:

total gross income from all sources may: (a) file as the other taxpayers or

“Georgia Income Tax Division”

(b) file their return by March 1, 2003 and pay the full amount of tax due by

that date.

Payment should be mailed to:

PURPOSE OF ESTIMATED TAX. The purpose is to enable taxpayers

having income not subject to withholding to currently pay their income tax.

Georgia Department of Revenue

Taxpayers are also required to file an annual return claiming credit thereon

P.O. Box 740319

for amounts paid or credited to their estimated tax.

Atlanta, Georgia 30374-0319

PAYMENT OF ESTIMATED TAX. Payment in full of your estimated tax may

be made with the first required installment or in equal installments during this

HOW TO COMPLETE FORM 500 ES PAYMENT. Calculate your estimated

year on or before April 15, June 15, September 15, and the following

tax by using the Schedule on Page 12. Line 12 is your estimated tax for

January 15. Please include your Social Security number on your check.

the year. Divide Line 12 by the number of quarters of liability (see “When

and Where to File” above) to compute the amount to be submitted quarterly.

HOW TO ESTIMATE YOUR TAX. A schedule for computing your esti-

Enter this amount on Form 500 ES and submit to the Georgia Income Tax

mated tax is enclosed. Tax rate schedules are furnished on Page 21.

Division. A coupon booklet will be sent to you for the remaining quarters.

PENALTIES. Failure to comply with the provisions of this law relative to

DEDUCTION AMOUNT FOR EACH EXEMPTION

underpayment of installments may result in the assessment of additional

EFFECTIVE TAX YEAR 2003.

charges as a penalty. Willful failure to pay estimated tax will constitute a

Personal Exemption for self and spouse ................................... $2,700

misdemeanor.

Dependent Exemption ................................................................ $3,000

STANDARD DEDUCTION.

Maximum Retirement Income Exclusion .................................... $15,000

Single and head of household .............................................. $2,300

Georgia Public Revenue Code Section 48-2-31 stipulates that

Married filing jointly ................................................................ $3,000

taxes shall be paid in lawful money of the United States,

Married filing separately ........................................................ $1,500

free of any expense to the State of Georgia.

Additional: Age 65 or older or blind. These additional deductions are for

you and your spouse but only if the standard deduction is used ($1,300).

These amounts are standard regardless of income.

MAIL ONLY THE COUPON AND PAYMENT. DO NOT MAIL ENTIRE PAGE

Cut along dotted line

500 ES

MAIL TO:

(rev. 7/02)

Individual Estimated Tax

Georgia Department of Revenue

Georgia Department of Revenue

P.O. Box 740319

2003

Atlanta, GA 30374-0319

USE THIS FORM FOR THE TAX YEAR INDICATED ONLY!

Telephone No. (404) 417-4480

Calendar Year Ending 2003 or Fiscal Year Ending__________20____

or 1-888-247-8175

Taxpayer’s SSN

Spouse’s SSN

Tax Year

Quarter

Due Date

Vendor Code

2003

N/A

NAME AND ADDRESS

If name and address is incorrect, mark the change of address box and make changes

TYPE OF RETURN

Address Change

Individual

Fiduciary

DO NOT STAPLE, PAPER CLIP OR ATTACH CHECK STUB

Amount Paid

Page 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1