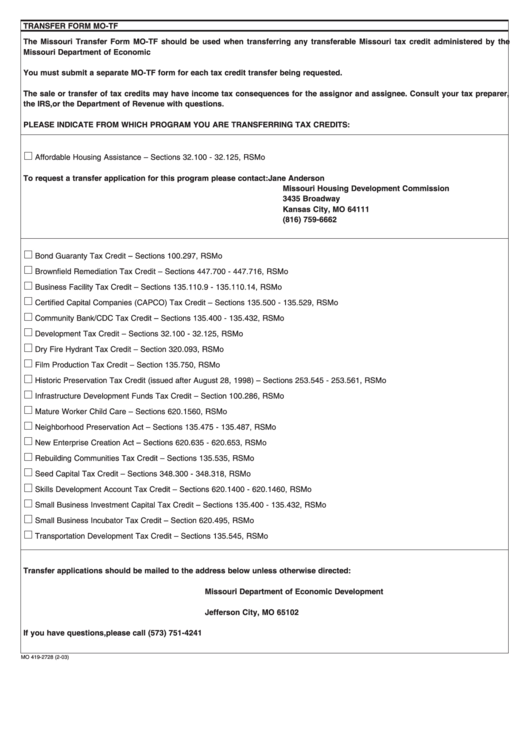

TRANSFER FORM MO-TF

The Missouri Transfer Form MO-TF should be used when transferring any transferable Missouri tax credit administered by the

Missouri Department of Economic Development. Eligible programs are listed below.

You must submit a separate MO-TF form for each tax credit transfer being requested.

The sale or transfer of tax credits may have income tax consequences for the assignor and assignee. Consult your tax preparer,

the IRS, or the Department of Revenue with questions.

PLEASE INDICATE FROM WHICH PROGRAM YOU ARE TRANSFERRING TAX CREDITS:

Affordable Housing Assistance – Sections 32.100 - 32.125, RSMo

To request a transfer application for this program please contact:

Jane Anderson

Missouri Housing Development Commission

3435 Broadway

Kansas City, MO 64111

(816) 759-6662

Bond Guaranty Tax Credit – Sections 100.297, RSMo

Brownfield Remediation Tax Credit – Sections 447.700 - 447.716, RSMo

Business Facility Tax Credit – Sections 135.110.9 - 135.110.14, RSMo

Certified Capital Companies (CAPCO) Tax Credit – Sections 135.500 - 135.529, RSMo

Community Bank/CDC Tax Credit – Sections 135.400 - 135.432, RSMo

Development Tax Credit – Sections 32.100 - 32.125, RSMo

Dry Fire Hydrant Tax Credit – Section 320.093, RSMo

Film Production Tax Credit – Section 135.750, RSMo

Historic Preservation Tax Credit (issued after August 28, 1998) – Sections 253.545 - 253.561, RSMo

Infrastructure Development Funds Tax Credit – Section 100.286, RSMo

Mature Worker Child Care – Sections 620.1560, RSMo

Neighborhood Preservation Act – Sections 135.475 - 135.487, RSMo

New Enterprise Creation Act – Sections 620.635 - 620.653, RSMo

Rebuilding Communities Tax Credit – Sections 135.535, RSMo

Seed Capital Tax Credit – Sections 348.300 - 348.318, RSMo

Skills Development Account Tax Credit – Sections 620.1400 - 620.1460, RSMo

Small Business Investment Capital Tax Credit – Sections 135.400 - 135.432, RSMo

Small Business Incubator Tax Credit – Section 620.495, RSMo

Transportation Development Tax Credit – Sections 135.545, RSMo

Transfer applications should be mailed to the address below unless otherwise directed:

Missouri Department of Economic Development

P.O. Box 118

Jefferson City, MO 65102

If you have questions, please call (573) 751-4241

MO 419-2728 (2-03)

1

1