Form Hr-1040 Sample - Homestead Rebate Application - 2000

ADVERTISEMENT

4 of 4

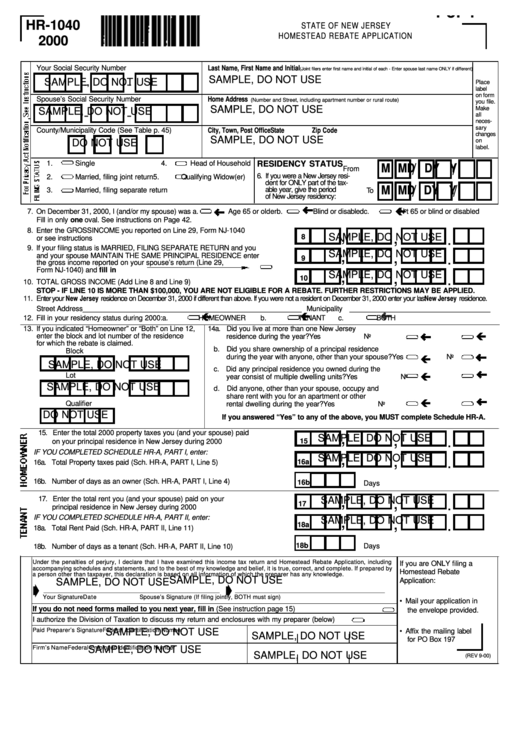

HR-1040

STATE OF NEW JERSEY

HOMESTEAD REBATE APPLICATION

2000

Your Social Security Number

Last Name, First Name and Initial

(Joint filers enter first name and initial of each - Enter spouse last name ONLY if different)

SAMPLE, DO NOT USE

SAMPLE, DO NOT USE

-

-

Place

label

on form

Spouse’s Social Security Number

Home Address

(Number and Street, including apartment number or rural route)

you file.

SAMPLE, DO NOT USE

Make

SAMPLE, DO NOT USE

-

-

all

neces-

sary

County/Municipality Code (See Table p. 45)

City, Town, Post Office

State

Zip Code

changes

SAMPLE, DO NOT USE

on

DO NOT USE

label.

1.

Single

4.

Head of Household

RESIDENCY STATUS

/

/

M M

D D

Y Y

From

6. If you were a New Jersey resi -

2.

Married, filing joint return

5.

Qualifying Widow(er)

dent for ONLY part of the tax-

/

/

M M

D D

Y Y

able year, give the period

3.

Married, filing separate return

To

of New Jersey residency:

ç

7. On December 31, 2000, I (and/or my spouse) was a.

Age 65 or older b.

Blind or disabled c.

Not 65 or blind or disabled

Fill in only one oval. See instructions on Page 42.

8. Enter the GROSS INCOME you reported on Line 29, Form NJ-1040

,

,

SAMPLE, DO NOT USE

8

.

or see instructions ................................................................................................

9. If your filing status is MARRIED, FILING SEPARATE RETURN and you

,

SAMPLE, DO NOT USE

,

and your spouse MAINTAIN THE SAME PRINCIPAL RESIDENCE enter

.

9

the gross income reported on your spouse’s return (Line 29,

Form NJ-1040) and fill in

,

SAMPLE, DO NOT USE

,

.

10

10. TOTAL GROSS INCOME (Add Line 8 and Line 9) ..............................................

STOP - IF LINE 10 IS MORE THAN $100,000, YOU ARE NOT ELIGIBLE FOR A REBATE. FURTHER RESTRICTIONS MAY BE APPLIED.

11. Enter your New Jersey residence on December 31, 2000 if different than above. If you were not a resident on December 31, 2000 enter your last New Jersey residence.

Street Address ________________________________________________________ Municipality ____________________________________

ç

ç

12. Fill in your residency status during 2000:

a.

HOMEOWNER

b.

TENANT

c.

BOTH

13. If you indicated “Homeowner” or “Both” on Line 12,

14a. Did you live at more than one New Jersey

ç

enter the block and lot number of the residence

residence during the year? .............................................

Yes

No

for which the rebate is claimed.

b. Did you share ownership of a principal residence

Block

during the year with anyone, other than your spouse? ....

ç

Yes

No

SAMPLE, DO NOT USE

c. Did any principal residence you owned during the

ç

Lot

year consist of multiple dwelling units? ..........................

Yes

No

SAMPLE, DO NOT USE

d. Did anyone, other than your spouse, occupy and

share rent with you for an apartment or other

ç

Qualifier

rental dwelling during the year? .....................................

Yes

No

DO NOT USE

If you answered “Yes” to any of the above, you MUST complete Schedule HR-A.

15. Enter the total 2000 property taxes you (and your spouse) paid

,

,

SAMPLE, DO NOT USE

.

15

on your principal residence in New Jersey during 2000 .........................

IF YOU COMPLETED SCHEDULE HR-A, PART I, enter:

,

SAMPLE, DO NOT USE

,

.

16a

16a. Total Property taxes paid (Sch. HR-A, PART I, Line 5) ..........................

16b. Number of days as an owner (Sch. HR-A, PART I, Line 4) ....................

16b

Days

,

17. Enter the total rent you (and your spouse) paid on your

SAMPLE, DO NOT USE

,

.

17

principal residence in New Jersey during 2000 ......................................

IF YOU COMPLETED SCHEDULE HR-A, PART II, enter:

,

SAMPLE, DO NOT USE

,

.

18a

18a. Total Rent Paid (Sch. HR-A, PART II, Line 11) .......................................

18b

Days

18b. Number of days as a tenant (Sch. HR-A, PART II, Line 10) ..................

Under the penalties of perjury, I declare that I have examined this income tax return and Homestead Rebate Application, including

If you are ONLY filing a

accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by

Homestead Rebate

a person other than taxpayer, this declaration is based on all information of which the preparer has any knowledge.

SAMPLE, DO NOT USE

Application:

SAMPLE, DO NOT USE

ç

ç

____________________________________________________________

___________________________________________________

Your Signature

Date

Spouse’s Signature (If filing jointly, BOTH must sign)

• Mail your application in

If you do not need forms mailed to you next year, fill in (See instruction page 15) ........................................

the envelope provided.

I authorize the Division of Taxation to discuss my return and enclosures with my preparer (below) ......

Paid Preparer’s Signature

SAMPLE, DO NOT USE

Federal Identification Number

• Affix the mailing label

SAMPLE, DO NOT USE

for PO Box 197

Firm’s Name

SAMPLE, DO NOT USE

Federal Employer Identification Number

SAMPLE, DO NOT USE

(REV 9-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1