For Official Use Only

Clear Form

Date received at county

Date received at Revenue

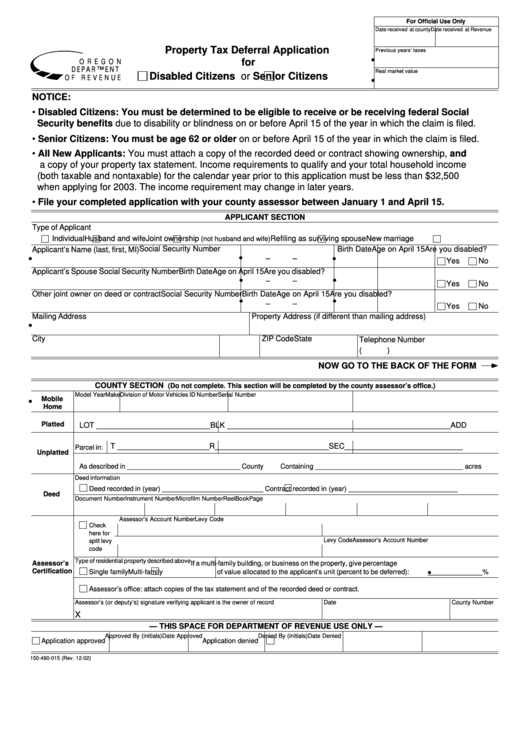

Property Tax Deferral Application

Previous years’ taxes

•

for

O R E G O N

D E PA R T M E N T

Real market value

Disabled Citizens or

Senior Citizens

O F R E V E N U E

•

Read Me

NOTICE:

• Disabled Citizens: You must be determined to be eligible to receive or be receiving federal Social

Security benefits due to disability or blindness on or before April 15 of the year in which the claim is filed.

• Senior Citizens: You must be age 62 or older on or before April 15 of the year in which the claim is filed.

• All New Applicants: You must attach a copy of the recorded deed or contract showing ownership, and

a copy of your property tax statement. Income requirements to qualify and your total household income

(both taxable and nontaxable) for the calendar year prior to this application must be less than $32,500

when applying for 2003. The income requirement may change in later years.

• File your completed application with your county assessor between January 1 and April 15.

APPLICANT SECTION

Type of Applicant

Individual

Husband and wife

Joint ownership

Refiling as surviving spouse

New marriage

(not husband and wife)

Social Security Number

Birth Date Age on April 15 Are you disabled?

Applicant’s Name (last, first, MI)

•

•

•

–

–

Yes

No

Applicant’s Spouse

Social Security Number

Birth Date Age on April 15 Are you disabled?

•

•

–

–

Yes

No

Other joint owner on deed or contract

Social Security Number

Birth Date Age on April 15 Are you disabled?

•

•

–

–

Yes

No

Mailing Address

Property Address (if different than mailing address)

•

City

State

ZIP Code

Telephone Number

(

)

NOW GO TO THE BACK OF THE FORM

COUNTY SECTION

(Do not complete. This section will be completed by the county assessor’s office.)

Model Year

Make

Division of Motor Vehicles ID Number

Serial Number

Mobile

•

Home

Platted

LOT __________________________

BLK ________________________

___________________________ADD

T _____________________

R__________________________

SEC___________________________

Parcel in:

Unplatted

As described in _____________________________ County

Containing ______________________________________ acres

Deed information

Deed recorded in (year) __________________________

Contract recorded in (year) ____________________________

Deed

Document Number

Instrument Number

Microfilm Number

Reel

Book

Page

Assessor’s Account Number

Levy Code

Check

here for

Assessor’s Account Number

Levy Code

split levy

code

Type of residential property described above

Assessor’s

If a multi-family building, or business on the property, give percentage

Certification

•

Single family

Multi-family

of value allocated to the applicant’s unit (percent to be deferred):

______________%

Assessor’s office: attach copies of the tax statement and of the recorded deed or contract.

Assessor’s (or deputy’s) signature verifying applicant is the owner of record

Date

County Number

X

— THIS SPACE FOR DEPARTMENT OF REVENUE USE ONLY —

Approved By (initials)

Date Approved

Denied By (initials)

Date Denied

Application approved

Application denied

150-490-015 (Rev. 12-02)

1

1 2

2