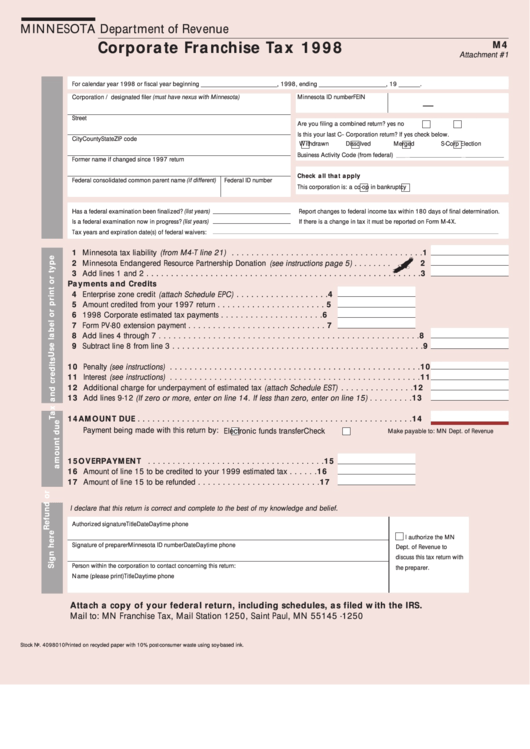

MINNESOTA Department of Revenue

Corporate Franchise Tax 1998

M4

Attachment #1

For calendar year 1998 or fiscal year beginning _________________________, 1998, ending ______________________, 19 _______.

Minnesota ID number

FEIN

Corporation / designated filer (must have nexus with Minnesota)

—

Street

Are you filing a combined return?

yes

no

Is this your last C-- Corporation return? If yes check below.

City

County

State

ZIP code

Withdrawn

Dissolved

Merged

S-Corp Election

Business Activity Code (from federal)

Former name if changed since 1997 return

Check all that apply

Federal consolidated common parent name (if different)

Federal ID number

This corporation is:

a co-op

in bankruptcy

Has a federal examination been finalized? (list years)

Report changes to federal income tax within 180 days of final determination.

Is a federal examination now in progress? (list years)

If there is a change in tax it must be reported on Form M-4X.

Tax years and expiration date(s) of federal waivers:

1 Minnesota tax liability (from M4-T line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Minnesota Endangered Resource Partnership Donation (see instructions page 5) . . . . . . . .

2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Payments and Credits

4 Enterprise zone credit (attach Schedule EPC) . . . . . . . . . . . . . . . . . . . 4

5 Amount credited from your 1997 return . . . . . . . . . . . . . . . . . . . . . . 5

6 1998 Corporate estimated tax payments . . . . . . . . . . . . . . . . . . . . . 6

7 Form PV-80 extension payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add lines 4 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Subtract line 8 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Additional charge for underpayment of estimated tax (attach Schedule EST) . . . . . . . . . . . . . . . 12

13 Add lines 9-12 (If zero or more, enter on line 14. If less than zero, enter on line 15) . . . . . . . . . 13

14 AMOUNT DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Payment being made with this return by:

Electronic funds transfer

Check

Make payable to: MN Dept. of Revenue

15 OVERPAYMENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Amount of line 15 to be credited to your 1999 estimated tax . . . . . . 16

17 Amount of line 15 to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . 17

I declare that this return is correct and complete to the best of my knowledge and belief.

Authorized signature

Title

Date

Daytime phone

I authorize the MN

Signature of preparer

Minnesota ID number

Date

Daytime phone

Dept. of Revenue to

discuss this tax return with

Person within the corporation to contact concerning this return:

the preparer.

Name (please print)

Title

Daytime phone

Attach a copy of your federal return, including schedules, as filed with the IRS.

Mail to: MN Franchise Tax, Mail Station 1250, Saint Paul, MN 55145 -1250

Stock No. 4098010

Printed on recycled paper with 10% post-consumer waste using soy-based ink.

1

1