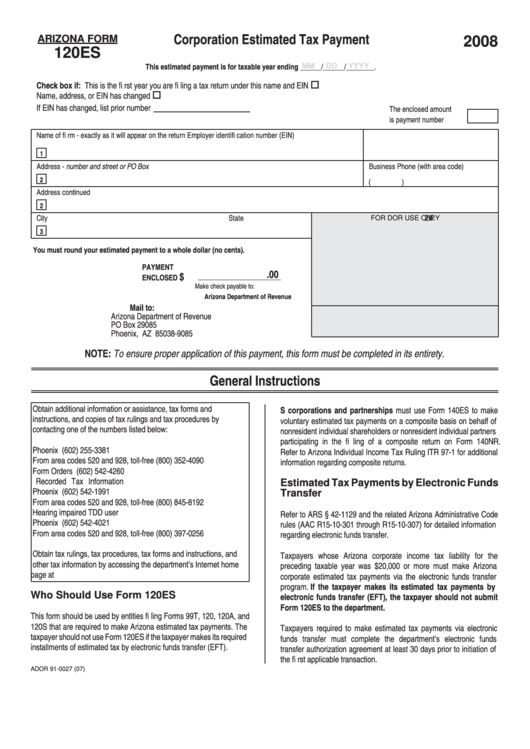

Arizona Form 120es - Corporation Estimated Tax Payment - 2008

ADVERTISEMENT

Corporation Estimated Tax Payment

ARIZONA FORM

2008

120ES

This estimated payment is for taxable year ending ______/______/________.

MM

MM

DD

DD

YYYY

YYYY

Check box if: This is the fi rst year you are fi ling a tax return under this name and EIN

Name, address, or EIN has changed

If EIN has changed, list prior number

The enclosed amount

is payment number

Name of fi rm - exactly as it will appear on the return

Employer identifi cation number (EIN)

1

Address - number and street or PO Box

Business Phone (with area code)

2

(

)

Address continued

2

City

State

ZIP code

FOR DOR USE ONLY

3

You must round your estimated payment to a whole dollar (no cents).

PAYMENT

.00

$

ENCLOSED

Make check payable to:

Arizona Department of Revenue

Mail to:

Arizona Department of Revenue

PO Box 29085

Phoenix, AZ 85038-9085

NOTE: To ensure proper application of this payment, this form must be completed in its entirety.

General Instructions

Obtain additional information or assistance, tax forms and

S corporations and partnerships must use Form 140ES to make

instructions, and copies of tax rulings and tax procedures by

voluntary estimated tax payments on a composite basis on behalf of

contacting one of the numbers listed below:

nonresident individual shareholders or nonresident individual partners

participating in the fi ling of a composite return on Form 140NR.

Phoenix

(602) 255-3381

Refer to Arizona Individual Income Tax Ruling ITR 97-1 for additional

From area codes 520 and 928, toll-free

(800) 352-4090

information regarding composite returns.

Form Orders

(602) 542-4260

Recorded Tax Information

Estimated Tax Payments by Electronic Funds

Phoenix

(602) 542-1991

Transfer

From area codes 520 and 928, toll-free

(800) 845-8192

Hearing impaired TDD user

Refer to ARS § 42-1129 and the related Arizona Administrative Code

Phoenix

(602) 542-4021

rules (AAC R15-10-301 through R15-10-307) for detailed information

From area codes 520 and 928, toll-free

(800) 397-0256

regarding electronic funds transfer.

Obtain tax rulings, tax procedures, tax forms and instructions, and

Taxpayers whose Arizona corporate income tax liability for the

other tax information by accessing the department’s Internet home

preceding taxable year was $20,000 or more must make Arizona

page at

corporate estimated tax payments via the electronic funds transfer

program. If the taxpayer makes its estimated tax payments by

Who Should Use Form 120ES

electronic funds transfer (EFT), the taxpayer should not submit

Form 120ES to the department.

This form should be used by entities fi ling Forms 99T, 120, 120A, and

120S that are required to make Arizona estimated tax payments. The

Taxpayers required to make estimated tax payments via electronic

taxpayer should not use Form 120ES if the taxpayer makes its required

funds transfer must complete the department’s electronic funds

installments of estimated tax by electronic funds transfer (EFT).

transfer authorization agreement at least 30 days prior to initiation of

the fi rst applicable transaction.

ADOR 91-0027 (07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2