Form 941a-Me Loose - Amended Return Of Maine Income Tax Withholding - 2006

ADVERTISEMENT

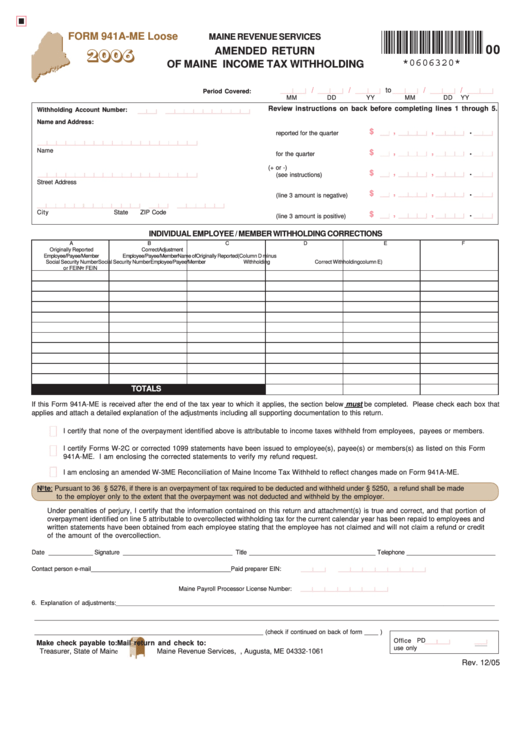

FORM 941A-ME Loose

MAINE REVENUE SERVICES

2006

00

AMENDED RETURN

*0606320*

OF MAINE INCOME TAX WITHHOLDING

/

/

/

/

to

Period Covered:

MM

DD

YY

MM

DD

YY

Review instructions on back before completing lines 1 through 5.

Withholding Account Number:

Name and Address:

1. Withholding originally

,

,

.

$

reported for the quarter ................

2. Correct withholding

Name

,

,

.

$

for the quarter ..............................

3. Amount of Adjustment (+ or -)

,

,

.

$

(see instructions) ..........................

Street Address

4. Underpayment to be paid

$

,

,

.

(line 3 amount is negative) ...........

5. Overpayment to be refunded

City

State

ZIP Code

$

,

,

.

(line 3 amount is positive) ............

INDIVIDUAL EMPLOYEE / MEMBER WITHHOLDING CORRECTIONS

A

B

C

D

E

F

Originally Reported

Correct

Adjustment

Employee/Payee/Member

Employee/Payee/Member

Name of

Originally Reported

(Column D minus

Social Security Number

Social Security Number

Employee/Payee/Member

Withholding

Correct Withholding

column E)

or FEIN

or FEIN

TOTALS

If this Form 941A-ME is received after the end of the tax year to which it applies, the section below must be completed. Please check each box that

applies and attach a detailed explanation of the adjustments including all supporting documentation to this return.

I certify that none of the overpayment identified above is attributable to income taxes withheld from employees, payees or members.

I certify Forms W-2C or corrected 1099 statements have been issued to employee(s), payee(s) or members(s) as listed on this Form

941A-ME. I am enclosing the corrected statements to verify my refund request.

I am enclosing an amended W-3ME Reconciliation of Maine Income Tax Withheld to reflect changes made on Form 941A-ME.

Note: Pursuant to 36 M.R.S.A. § 5276, if there is an overpayment of tax required to be deducted and withheld under § 5250, a refund shall be made

to the employer only to the extent that the overpayment was not deducted and withheld by the employer.

Under penalties of perjury, I certify that the information contained on this return and attachment(s) is true and correct, and that portion of

overpayment identified on line 5 attributable to overcollected withholding tax for the current calendar year has been repaid to employees and

written statements have been obtained from each employee stating that the employee has not claimed and will not claim a refund or credit

of the amount of the overcollection.

Date _____________ Signature ________________________________ Title _____________________________________ Telephone __________________________

Contact person e-mail _________________________________________

Paid preparer EIN:

Maine Payroll Processor License Number:

6. Explanation of adjustments: _______________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

___________________________________________________________________ (check if continued on back of form ____ )

Office

PD

Make check payable to:

Mail return and check to:

use only

Treasurer, State of Maine

Maine Revenue Services, P.O. Box 1061, Augusta, ME 04332-1061

Rev. 12/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1