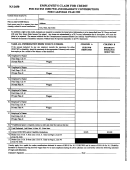

Form Nj-2450 - Employee'S Claim For Credit - 2010 Page 2

ADVERTISEMENT

INSTRUCTIONS FOR OBTAINING

A CREDIT FOR EXCESS UI/WF/SWF, DISABILITY INSURANCE AND/OR FAMILY

LEAVE INSURANCE CONTRIBUTIONS

In order to claim the credit, Form NJ-2450, Employee’s Claim for Credit for Excess UI/WF/SWF

(Unemployment Insurance/Workforce Development Partnership Fund/Supplemental Workforce

Fund), Disability Insurance, and/or Family Leave Insurance Contributions must be enclosed with

the NJ-1040 return. If this form is not enclosed with the NJ-1040 and if the required information

from the W-2 forms is not available to substantiate the claim, the claim for credit will be denied.

The Law prohibits the processing of claims submitted later than two years after the calendar year

in which wages were paid.

If a joint NJ-1040 return is filed and both spouses/CU couple have excess contributions withheld

by two or more employers, each spouse/CU partner must file their own claim form along with

the NJ-1040 return.

If any single employer withholds more than the maximum for either UI/WF/SWF, disability

insurance, and/or family leave insurance contributions, you are to enter only the maximum on the

claim form. Any amounts over the maximum were incorrectly withheld and must be refunded

by that particular employer. Refunds of overwithholdings of contributions by an individual

employer are the responsibility of that employer and are not subject to be claimed as a credit on

your Gross Income Tax Return.

If additional space is required due to the number of employers, enclose a list with the required

information as on the NJ-2450 form. If this rider is incomplete or not enclosed with the claim,

the claim for credit will be denied.

After lines 1A through 1G are completed, complete all necessary calculations from Lines 2

through 6. Carry the amounts on Line 4, 5, and/or 6 to the specified lines on Page 3 of the NJ-

1040 return.

If you are notified that your claim has been denied by the Division of Taxation for lack of

information or any other reason, you must refile your claim for refund of excess UI/WF/SWF,

disability insurance, or family leave insurance contributions with the Department of Labor and

Workforce Development on Form UC-9A, “Employees Claim for Refund of Excess

Contributions.” Once your claim has been denied by the Division of Taxation, it cannot be

reinstated.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2