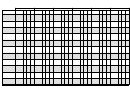

Form Ifta-105 - Ifta Final Fuel Use Tax Rate And Rate Code Table 1 - 2002 Page 2

ADVERTISEMENT

Use for 1ST Quarter 2002 only.

IFTA-105

Note: Gallon

Liter

U.S./Canada exchange rate - 1.5646/.6391

- U.S. $ per gallon (p/g);

- Canadian $ per liter (p/l)

D (Diesel)

G (Motor Fuel Gasoline)

E (Ethanol)

P (Propane (LPG))

C (CNG (Natural Gas))

Rate

Rate

Rate

Rate

Rate

**

**

**

**

**

Jurisdiction

Code Gallon

Liter

Code Gallon

Liter

Code Gallon

Liter

Code Gallon

Liter

Code Gallon

Liter

Effective Date

Effective Date

Effective Date

Effective Date

Effective Date

Newfoundland

NF

025 .3992

.165

025 .3992 .165

025 N/A

N/A

025 .1693 .07

025 N/A

N/A

New Hampshire

NH

021 .18

.0744

021 N/A

N/A

021 N/A

N/A

021 N/A

N/A

021 N/A

N/A

NJ

New Jersey

023 .175

.0723

023 .145

.0599

023 .145

.0599

023 .0925 .0382

023 .0925 .0382

NM

New Mexico

027 .18

.0744

025 N/A

N/A

025 N/A

N/A

027 N/A

N/A

026 N/A

N/A

New York

NY

025 .2995

.1238

025 .313

.1294

025 .313

.1294

025 .167

.069

025 .313

.1294

NC

No. Carolina

027 .242

.10

027 .242

.10

027 .242

.10

027 .242

.10

027 .242

.10

ND

No. Dakota

027 .21

.0868

027 .21

.0868

027 N/A

N/A

027 .21

.0868

027 .21

.0868

NS

Nova Scotia

025 .3726

.154

025 .3266 .135

025 N/A

N/A

025 .1693 .07

025 N/A

N/A

Ohio

OH

053 .22

.0909

053 .22

.0909

053 .22

.0909

053 .22

.0909

041 N/A

N/A

*

OH

Ohio

054 .03

.0124

054 .03

.0124

054 .03

.0124

054 .03

.0124

N/A N/A

N/A

OK

Oklahoma

027 .13

.0537

027 .16

.0661

027 N/A

N/A

027 .16

.0661

027 .16

.0661

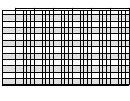

9

9

ON

Ontario

021 .3459

.143

021 .3556 .147

021 N/A

N/A

021 .104

.043

021 N/A

N/A

Oregon

OR

025 N/A

N/A

025 N/A

N/A

025 N/A

N/A

025 N/A

N/A

025 N/A

N/A

10

10

10

10

PA

Pennsylvania

032 .318

.1315

032 .266

.11

032 .178

.0736

032 .194

.0802

032 .067

.0277

Prince Edward Is PE

026 .3266

.135

026 .3145 .13

025 N/A

N/A

026 .3145 .13

025 N/A

N/A

Quebec

PQ

027 .3919

.162

025 .3677 .152

025 .3919

.162

025 N/A

N/A

025 N/A

N/A

11

11

Rhode Island

RI

023 .28

.1158

023 .28

.1158

023 .28

.1158

023 .28

.1158

023 N/A

N/A

SK

Saskatchewan

027 .3629

.15

027 .3629 .15

027 .3629

.15

027 .2177 .09

025 N/A

N/A

So. Carolina

SC

025 .16

.0661

025 .16

.0661

025 .16

.0661

025 .16

.0661

025 .16

.0661

SD

So. Dakota

027 .22

.0909

025 N/A

N/A

025 N/A

N/A

027 .20

.0827

027 .10

.0413

TN

Tennessee

027 .17

.0703

027 .20

.0827

025 N/A

N/A

027 .14

.0579

025 N/A

N/A

12

12

Texas

TX

027 .20

.0827

027 .20

.0827

027 .20

.0827

027 .15

.062

027 .15

.062

13

13

Utah

UT

027 .245

.1013

027 .245

.1013

027 .245

.1013

027 N/A

N/A

027 N/A

N/A

VT

Vermont

035 .26

.1075

022 N/A

N/A

022 N/A

N/A

022 N/A

N/A

022 N/A

N/A

Virginia

VA

049 .16

.0661

049 .16

.0661

049 .16

.0661

049 .16

.0661

049 .16

.0661

*

Virginia

VA

050 .035

.0145

050 .035

.0145

050 .035

.0145

050 .035

.0145

050 .035

.0145

WA

Washington

027 .23

.0951

027 .23

.0951

027 .23

.0951

025 N/A

N/A

025 N/A

N/A

West Virginia

WV

025 .2535

.1048

025 .2535 .1048

025 .2535

.1048

025 .2535 .1048

025 .2535 .1048

Wisconsin

WI

027 .303

.1253

027 .303

.1253

027 .303

.1253

027 .20

.0827

027 .218

.0901

WY

Wyoming

027 .14

.0579

027 .14

.0579

027 N/A

N/A

025 N/A

N/A

025 N/A

N/A

6

Carriers need to file supplemental return with MI for non-highway use of taxed diesel fuel purchases and payment of full tax rate when purchasing diesel fuel into decaled vehicle.

7

Natural gas - LNG and CNG 100 cubic feet.

8

Obtaining proper fuel decals eliminates the need for reporting propane and/or natural gas. Not obtaining fuel decals requires filing of fuel tax return using .17 rates.

9

Licensees may apply to ON for tax refund in respect of ethanol or methanol component of blend.

10

To convert CNG(scf) to gals, multiply units by .0314. To convert CNG (lbs) to gals, multiply units by .7087. Effective 10/1/97, dyed diesel fuel or dyed kerosene

consumed in PA operations, by qualified motor vehicles authorized by IRS to use dyed fuel on highway, is not taxable.

11

Effective 1/1/98, propane gas and ethanol gasahol (containing 85% or more by volume of ethanol or other blend of alcohol) use in fleet of 10 or more alternative fueled

vehicles are exempt from fuel use tax.

12

Effective 9/1/09, volume of water, fuel ethanol or biodiesel blended with petroleum diesel fuel is exempt from fuel use tax and refunds for TX fuel use taxes paid for these

fuels via IFTA tax returns may be requested from TX comptroller of public accounts. Continue to report water based emulsions,fuel ethanol on biodiesel fuel blends on IFTA

tax returns.

13

Tax on propane and natural gas (clean fuels in UT) is paid via purchase of clean special fuel certificate (Form TC-596). Form TC-596=$82 for 2 axle vehicle with re. gross vehicle

weight of 26,000 lbs. or less and $126 for 3 axle vehicle or reg. gross vehicle weight over 26,000. Penalty in addition to federal penalties will be imposed for using dyed fuel on highways.

*

Surcharge

IFTA-105 (3/02) (back)

**

Period rate change is effective

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2