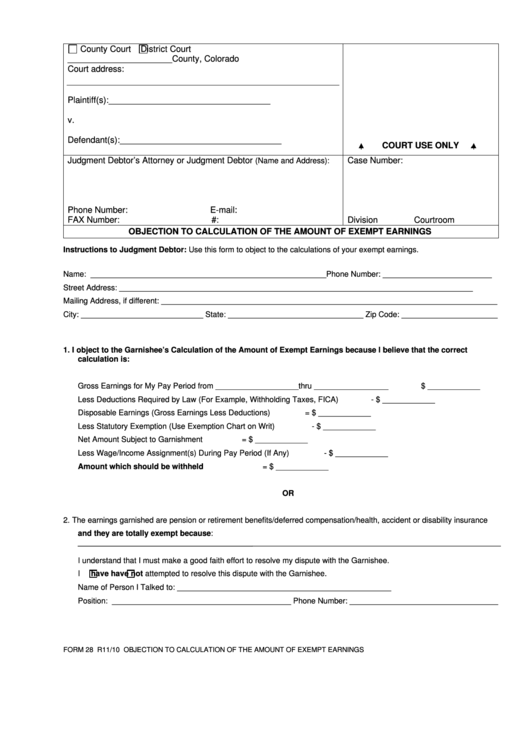

County Court

District Court

______________________County, Colorado

Court address:

Plaintiff(s):__________________________________

v.

Defendant(s):__________________________________

COURT USE ONLY

Judgment Debtor’s Attorney or Judgment Debtor

Case Number:

(Name and Address):

Phone Number:

E-mail:

FAX Number:

Atty.Reg. #:

Division

Courtroom

OBJECTION TO CALCULATION OF THE AMOUNT OF EXEMPT EARNINGS

Instructions to Judgment Debtor: Use this form to object to the calculations of your exempt earnings.

Name: ______________________________________________________Phone Number: _________________________

Street Address: _________________________________________________________________________________

Mailing Address, if different: _____________________________________________________________________________

City: ____________________________ State: _______________________________ Zip Code: ______________________

1.

I object to the Garnishee’s Calculation of the Amount of Exempt Earnings because I believe that the correct

calculation is:

Gross Earnings for My Pay Period from ___________________thru _________________

$ ____________

Less Deductions Required by Law (For Example, Withholding Taxes, FICA)

- $ ____________

Disposable Earnings (Gross Earnings Less Deductions)

= $ ____________

Less Statutory Exemption (Use Exemption Chart on Writ)

- $ ____________

Net Amount Subject to Garnishment

= $ ____________

Less Wage/Income Assignment(s) During Pay Period (If Any)

- $ ____________

Amount which should be withheld

= $ ____________

OR

2.

The earnings garnished are pension or retirement benefits/deferred compensation/health, accident or disability insurance

and they are totally exempt because:

_________________________________________________________________________________________________

I understand that I must make a good faith effort to resolve my dispute with the Garnishee.

I

have

have not attempted to resolve this dispute with the Garnishee.

Name of Person I Talked to: _________________________________________________

Position: _________________________________________ Phone Number: __________________________________

FORM 28

R11/10

OBJECTION TO CALCULATION OF THE AMOUNT OF EXEMPT EARNINGS

1

1 2

2