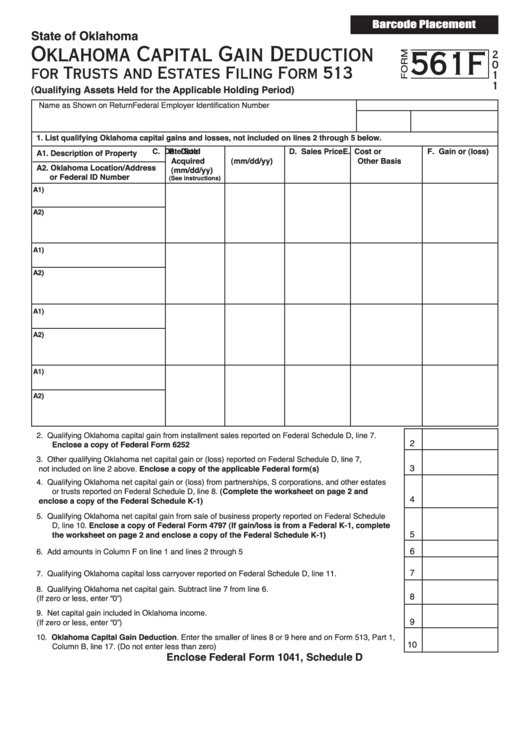

Form 561f - Oklahoma Capital Gain Deduction For Trusts And Estates - 2011

ADVERTISEMENT

Barcode Placement

State of Oklahoma

Oklahoma Capital Gain Deduction

561F

2

0

for Trusts and Estates Filing Form 513

1

1

(Qualifying Assets Held for the Applicable Holding Period)

Name as Shown on Return

Federal Employer Identification Number

1. List qualifying Oklahoma capital gains and losses, not included on lines 2 through 5 below.

B. Date

C. Date Sold

D. Sales Price

E. Cost or

F. Gain or (loss)

A1. Description of Property

Acquired

(mm/dd/yy)

Other Basis

A2. Oklahoma Location/Address

(mm/dd/yy)

or Federal ID Number

(See instructions)

A1)

A2)

A1)

A2)

A1)

A2)

A1)

A2)

2.

Qualifying Oklahoma capital gain from installment sales reported on Federal Schedule D, line 7.

2

Enclose a copy of Federal Form 6252 ..............................................................................................

3.

Other qualifying Oklahoma net capital gain or (loss) reported on Federal Schedule D, line 7,

3

not included on line 2 above. Enclose a copy of the applicable Federal form(s) ............................

4.

Qualifying Oklahoma net capital gain or (loss) from partnerships, S corporations, and other estates

or trusts reported on Federal Schedule D, line 8. (Complete the worksheet on page 2 and

4

enclose a copy of the Federal Schedule K-1) ..................................................................................

5.

Qualifying Oklahoma net capital gain from sale of business property reported on Federal Schedule

D, line 10. Enclose a copy of Federal Form 4797 (If gain/loss is from a Federal K-1, complete

5

the worksheet on page 2 and enclose a copy of the Federal Schedule K-1)................................

6

6.

Add amounts in Column F on line 1 and lines 2 through 5...................................................................

7

7.

Qualifying Oklahoma capital loss carryover reported on Federal Schedule D, line 11. ........................

8.

Qualifying Oklahoma net capital gain. Subtract line 7 from line 6.

8

(If zero or less, enter “0”) ......................................................................................................................

9.

Net capital gain included in Oklahoma income.

9

(If zero or less, enter “0”) ......................................................................................................................

10. Oklahoma Capital Gain Deduction. Enter the smaller of lines 8 or 9 here and on Form 513, Part 1,

10

Column B, line 17. (Do not enter less than zero) .................................................................................

Enclose Federal Form 1041, Schedule D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3