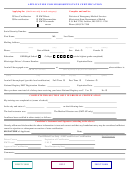

APPLICANTS SEEKING IN-STATE STATUS AS A MARYLAND RESIDENT MUST COMPLETE THE FOLLOWING QUESTIONS. Failure to complete all of

the required items may result in a non-Maryland resident classification and out-of-state charges being applied. Residency classification information is

evaluated in accordance with the University System of Maryland policy on residency. The applicant may be contacted for clarification of an item, or for

additional information as necessary.

PLEASE CHECK ONE:

____ I am financially independent. I have earned taxable income and I have not been claimed as a dependent on another person's most recent income tax

returns.

____ I am financially dependent on another person who has claimed me as a dependent on his/her most recent income tax returns, or I am a ward of the State

of Maryland. If a ward of the State, please submit documentation and go to item 10.

Name of person upon whom dependent and relationship to applicant:__________________________________________________________________

a. How long have you been dependent upon this person? __________________________ b. Is the person a resident of Maryland? ___Yes ___No

c. Address of this person:_____________________________________________________________________________________________________

d. Has this person filed a Maryland state income tax return for the most recent year on all earned taxable income? ___Yes ___No

i. If a Maryland tax return has not been filed within the last 12 months, state reason(s): ________________________________________________

Signature of this person: _________________________________________________________________________________________________

The Student Applicant is responsible for completing items 1-10.

1. Permanent address:________________________________________________________________ City:_________________________________________

State:______________________________ Zip Code:____________________ Length of time at permanent address: ______Years ______Months

If less than 12 months, provide previous address:____________________________________________ City:_________________________________________

State:______________________________ Zip Code:____________________ Length of time at previous address: ______Years ______Months

2. Did you move to Maryland primarily to attend an educational institution?

____Yes

____No

3. Are all, or substantially all of your possessions in Maryland?

____Yes

____No

4. Do you possess a valid driver's license?

____Yes

____No

a. If yes, initial date of issue:________________

b. In what state? _________________________

c. Most recent date of issue:________________

d. In what state? _________________________

5. Do you own any motor vehicles?

____Yes

____No

a. If yes, initial date of registration:________________

b. In what state? _________________________

c. Most recent date of registration:________________

d. In what state? _________________________

6. Are you registered to vote?

a . If yes, in what state? ___________________

b. Date of registration:______________

____Yes

____No

c. Were you previously registered to vote in another state?____________

7. Have you filed a Maryland state income tax return for the most recent year?

____Yes

____No

a. If a Maryland tax return has not been filed within the last 12 months, state reason(s):_________________________________________

______________________________________________________________________________________________________________

8. Is Maryland state income tax currently being withheld from your pay? If no, provide explanation.

____Yes

____No

______________________________________________________________________________________________________________

9. Do you receive any public assistance from a state or local agency other than one in Maryland?

____Yes

____No

a. If yes, indicate type and issuing state:______________________________________________________________________________

I certify that the information provided is complete and correct. I understand that the University reserves the right to request additional information if

necessary. In the event the University discovers that false or misleading information has been provided, the Student Applicant may be billed by the

University retroactively to recover the difference between in-state and out-of-state tuition for the current and subsequent semesters.

10. _______________________________________________________________________________________________________________________________

Signature of Applicant

Date

Email Address

Rev. 07/2015

1

1 2

2