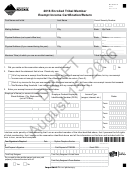

Montana Form Etm Draft - Enrolled Tribal Member Exempt Income Certification/return - 2015 Page 2

ADVERTISEMENT

Form ETM Instructions

●

$4,370 if your filing status is single or married filing

Reminder! You no longer have to file a Montana income

separately ($6,700 if you are 65 or older)

tax return (Form 2) if you are a tribal member and all of your

●

$4,370 if your filing status is head of a household

income is exempt from Montana income tax. Form IND,

($6,700 if you are 65 or older)

Tribal Member Certification, has been replaced with this

form, which will serve as your return.

●

$8,740 if your filing status is married filing jointly with

your spouse ($11,070 if you or your spouse is 65 or

If only part of your income is exempt from Montana income

older and $13,400 if both spouses are 65 or older)

tax, you will need to include this form with Montana Form 2.

The filing threshold is increased by $2,330 if an individual is

blind.

Heading

Line 3 – Complete the exempt income information table.

Print your name, mailing address, physical address(es) and

Provide the name of your employer(s) or the source of your

social security number in the spaces provided. If you lived at

exempt income. If you are self-employed, enter your business

more than two addresses during the year, include a separate

name.

sheet listing the locations and dates. Also include the name of

If you are not self-employed, enter the FEIN of your employer.

the Montana tribe of which you are an enrolled member and

If you are a wage earner, this information will be available on

your tribal enrollment number.

the federal Form W-2 you received from your employer.

Line 1 – Please check “Yes” if you resided on the reservation

Enter the physical address where the wages were earned

where you are an enrolled member for the entire year. Check

or services provided and the dates work was performed. If

“No” if you resided off the reservation where you are an

necessary, attach a sheet listing additional income claimed as

enrolled member at any time during the year.

exempt.

Line 2 – Check the box next to the statement that is true. The

Enter the type of income received that is exempt from

first box should be marked if either of the following applies

Montana income tax. Please do not enter the amount.

to you: (1) all of your income is exempt, or (2) you had both

exempt and non-exempt income but the non-exempt amount

Signature Block

did not exceed the filing threshold for your age and filing

This is not considered a valid certification or return unless

status.

you sign it. If you are filing electronically, the act of filing

Also, check this box and submit it with Form 2 in order to

electronically signifies your declaration, under the penalty of

request a refund of any Montana tax withheld or payments you

false swearing, that:

made.

●

You are the taxpayer identified on the form; and

The second box should be marked if you had both exempt and

●

The information in the claim is true, correct and

non-exempt income and your non-exempt income exceeded

complete.

the applicable filing status. If this is the case, you are required

Your filing electronically, with this declaration, is your

to file Form 2 to pay Montana income tax on the non-exempt

portion of your income.

signature.

Income is exempt from Montana income tax if all of the

If you want to allow your preparer, a friend, a family member

or any other person you choose to discuss this form with the

following requirements are met:

department, mark the “Yes” box in the Third Party Designee

●

You are an enrolled tribal member of the governing

section of the signature block. You must also enter the

tribe of a reservation;

designee’s printed name and phone number. If you do not

●

You resided and worked on that reservation; and

complete this section in its entirety, we cannot discuss this

form with a third party.

●

You earned the income by working on that

reservation.

Where to File

The following income is not exempt from Montana income tax:

You can file Form ETM (and Form 2) electronically on our

●

Income you earn from working on a reservation

website. Filing electronically is simple and secure, and

where you are not an enrolled tribal member of the

you receive confirmation that the form was filed. For more

governing tribe

information, visit revenue.mt.gov and click on Taxpayer Access

Point (TAP). You can also mail Form ETM to:

●

Income you earn from working outside the reservation

where you are an enrolled member, including income

Montana Department of Revenue

you earned in another state

PO Box 6577

Helena, MT 59604-6577

●

Income you earn while you are not residing on the

reservation where you are an enrolled member.

Administrative Rules of Montana: 42.15.220

You are required to file Form 2 if your non-exempt income

Questions? For additional information regarding the taxation

exceeds the filing threshold. The threshold for filing depends

of Native Americans or the third party designation, please visit

on your filing status. For 2015, the filing thresholds are as

our website at revenue.mt.gov. You may also call us toll free at

follows:

(866) 859-2254 (in Helena, 444-6900).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2