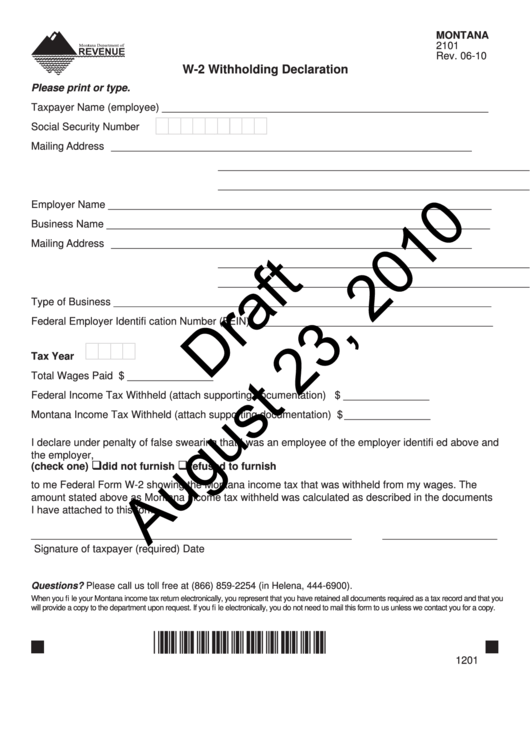

Form W-2 Draft - Withholding Declaration - Montana Department Of Revenue

ADVERTISEMENT

MONTANA

2101

Rev. 06-10

W-2 Withholding Declaration

Please print or type.

Taxpayer Name (employee) _________________________________________________________

Social Security Number

Mailing Address

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

Employer Name ___________________________________________________________________

Business Name ___________________________________________________________________

Mailing Address

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

Type of Business __________________________________________________________________

Federal Employer Identifi cation Number (FEIN) __________________________________________

Tax Year

Total Wages Paid ................................................................................................... $ _______________

Federal Income Tax Withheld (attach supporting documentation) ....................... $ _______________

Montana Income Tax Withheld (attach supporting documentation) ...................... $ _______________

I declare under penalty of false swearing that I was an employee of the employer identifi ed above and

the employer,

(check one)

did not furnish

refused to furnish

to me Federal Form W-2 showing the Montana income tax that was withheld from my wages. The

amount stated above as Montana income tax withheld was calculated as described in the documents

I have attached to this form.

________________________________________________________

____________________

Signature of taxpayer (required)

Date

Questions? Please call us toll free at (866) 859-2254 (in Helena, 444-6900).

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required as a tax record and that you

will provide a copy to the department upon request. If you fi le electronically, you do not need to mail this form to us unless we contact you for a copy.

*12010101*

1201

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1