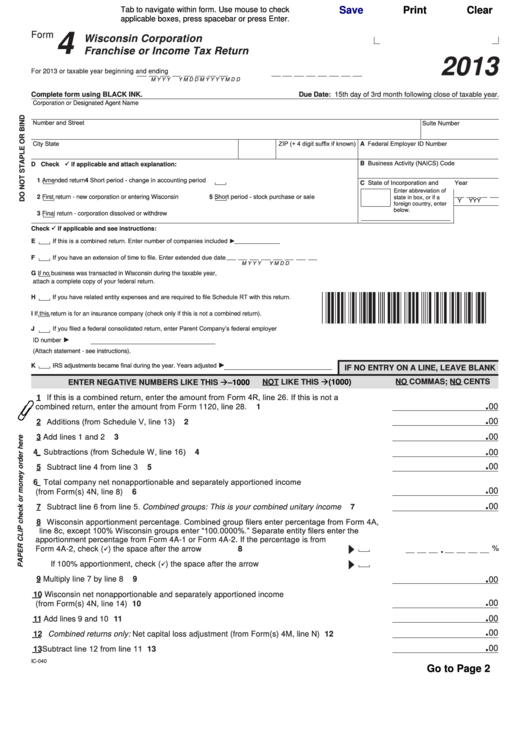

Save

Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Form

4

Wisconsin Corporation

Franchise or Income Tax Return

2013

For 2013 or taxable year beginning

and ending

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

Complete form using BLACK INK.

Due Date: 15th day of 3rd month following close of taxable year.

Corporation or Designated Agent Name

Number and Street

Suite Number

State

ZIP (+ 4 digit suffix if known)

A Federal Employer ID Number

City

B Business Activity (NAICS) Code

D Check

if applicable and attach explanation:

Short period - change in accounting period

1

Amended return

4

and

Year

C State of Incorporation

Enter abbreviation of

Short period - stock purchase or sale

2

First return - new corporation or entering Wisconsin

5

state in box, or if a

Y

Y

Y

Y

foreign country, enter

below.

3

Final return - corporation dissolved or withdrew

Check

if applicable and see instructions:

If this is a combined return. Enter number of companies included ►

E

If you have an extension of time to file. Enter extended due date

F

M

M

D

D

Y

Y

Y

Y

G

If no business was transacted in Wisconsin during the taxable year,

attach a complete copy of your federal return.

If you have related entity expenses and are required to file Schedule RT with this return.

H

I

If this return is for an insurance company (check only if this is not a combined return).

If you filed a federal consolidated return, enter Parent Company’s federal employer

J

►

ID number

(Attach statement - see instructions).

►

IRS adjustments became final during the year. Years adjusted

K

IF NO ENTRY ON A LINE, LEAVE BLANK

(1000)

–1000

NOT LIKE THIS

NO COMMAS; NO CENTS

ENTER NEGATIVE NUMBERS LIKE THIS

1 If this is a combined return, enter the amount from Form 4R, line 26. If this is not a

.

00

combined return, enter the amount from Form 1120, line 28. . . . . . . . . . . . . . . . . . . . . . . . . .

1

.

2 Additions (from Schedule V, line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

2

.

00

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Subtractions (from Schedule W, line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

4

00

.

5 Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

5

6 Total company net nonapportionable and separately apportioned income

.

00

(from Form(s) 4N, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

.

7 Subtract line 6 from line 5. Combined groups: This is your combined unitary income . . . . . . .

00

7

8 Wisconsin apportionment percentage. Combined group filers enter percentage from Form 4A,

line 8c, except 100% Wisconsin groups enter “100.0000%.” Separate entity filers enter the

apportionment percentage from Form 4A-1 or Form 4A-2. If the percentage is from

.

%

Form 4A-2, check (

) the space after the arrow . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

If 100% apportionment, check (

) the space after the arrow . . . . . . . . . . . . . . . . . . . .

.

9 Multiply line 7 by line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Wisconsin net nonapportionable and separately apportioned income

.

00

(from Form(s) 4N, line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.

00

11 Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

00

12 Combined returns only: Net capital loss adjustment (from Form(s) 4M, line N) . . . . . . . . . . . . 12

.

13 Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

IC-040

Go to Page 2

1

1 2

2 3

3