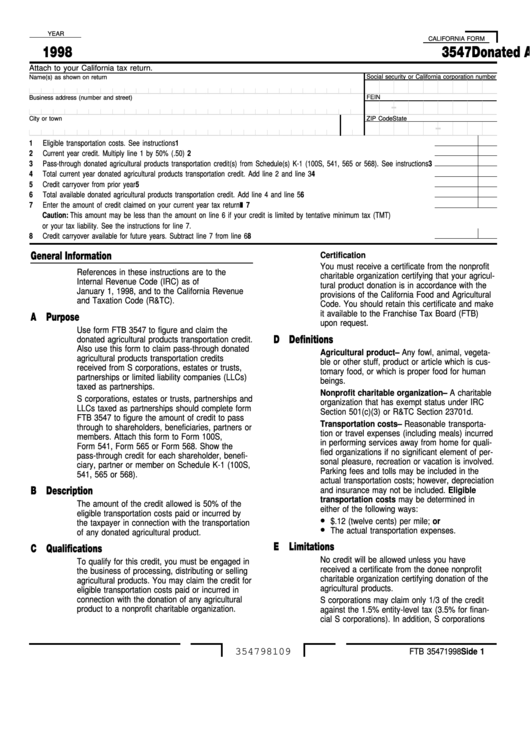

YEAR

CALIFORNIA FORM

1998

Donated Agricultural Products Transportation Credit

3547

Attach to your California tax return.

Social security or California corporation number

Name(s) as shown on return

FEIN

Business address (number and street)

City or town

State

ZIP Code

1

Eligible transportation costs. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Current year credit. Multiply line 1 by 50% (.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Pass-through donated agricultural products transportation credit(s) from Schedule(s) K-1 (100S, 541, 565 or 568). See instructions 3

4

Total current year donated agricultural products transportation credit. Add line 2 and line 3 . . . . . . . . . . . . . . . . . . . . . .

4

5

Credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6

Total available donated agricultural products transportation credit. Add line 4 and line 5 . . . . . . . . . . . . . . . . . . . . . . .

6

7

Enter the amount of credit claimed on your current year tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Caution: This amount may be less than the amount on line 6 if your credit is limited by tentative minimum tax (TMT)

or your tax liability. See the instructions for line 7.

8

Credit carryover available for future years. Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

General Information

Certification

You must receive a certificate from the nonprofit

References in these instructions are to the

charitable organization certifying that your agricul-

Internal Revenue Code (IRC) as of

tural product donation is in accordance with the

January 1, 1998, and to the California Revenue

provisions of the California Food and Agricultural

and Taxation Code (R&TC).

Code. You should retain this certificate and make

it available to the Franchise Tax Board (FTB)

A Purpose

upon request.

Use form FTB 3547 to figure and claim the

D Definitions

donated agricultural products transportation credit.

Also use this form to claim pass-through donated

Agricultural product – Any fowl, animal, vegeta-

agricultural products transportation credits

ble or other stuff, product or article which is cus-

received from S corporations, estates or trusts,

tomary food, or which is proper food for human

partnerships or limited liability companies (LLCs)

beings.

taxed as partnerships.

Nonprofit charitable organization – A charitable

S corporations, estates or trusts, partnerships and

organization that has exempt status under IRC

LLCs taxed as partnerships should complete form

Section 501(c)(3) or R&TC Section 23701d.

FTB 3547 to figure the amount of credit to pass

Transportation costs – Reasonable transporta-

through to shareholders, beneficiaries, partners or

tion or travel expenses (including meals) incurred

members. Attach this form to Form 100S,

in performing services away from home for quali-

Form 541, Form 565 or Form 568. Show the

fied organizations if no significant element of per-

pass-through credit for each shareholder, benefi-

sonal pleasure, recreation or vacation is involved.

ciary, partner or member on Schedule K-1 (100S,

Parking fees and tolls may be included in the

541, 565 or 568).

actual transportation costs; however, depreciation

B Description

and insurance may not be included. Eligible

transportation costs may be determined in

The amount of the credit allowed is 50% of the

either of the following ways:

eligible transportation costs paid or incurred by

•

$.12 (twelve cents) per mile; or

the taxpayer in connection with the transportation

•

The actual transportation expenses.

of any donated agricultural product.

E Limitations

C Qualifications

No credit will be allowed unless you have

To qualify for this credit, you must be engaged in

received a certificate from the donee nonprofit

the business of processing, distributing or selling

charitable organization certifying donation of the

agricultural products. You may claim the credit for

agricultural products.

eligible transportation costs paid or incurred in

connection with the donation of any agricultural

S corporations may claim only 1/3 of the credit

product to a nonprofit charitable organization.

against the 1.5% entity-level tax (3.5% for finan-

cial S corporations). In addition, S corporations

354798109

FTB 3547 1998 Side 1

1

1 2

2