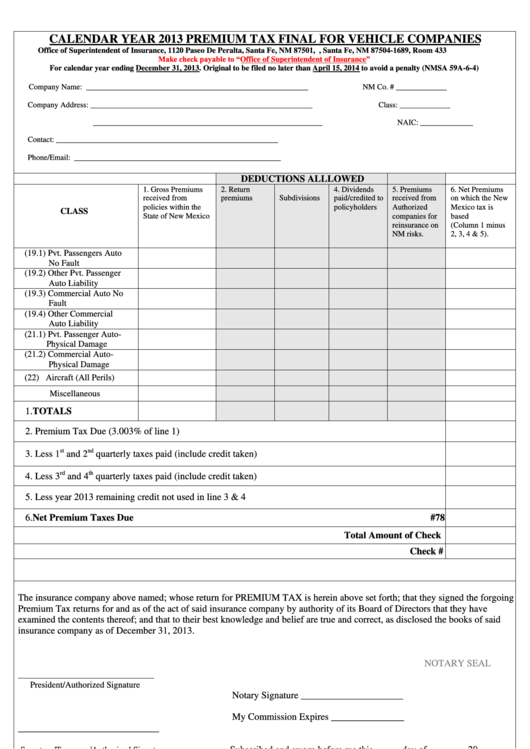

CALENDAR YEAR 2013 PREMIUM TAX FINAL FOR VEHICLE COMPANIES

Office of Superintendent of Insurance, 1120 Paseo De Peralta, Santa Fe, NM 87501, P.O. Box 1689, Santa Fe, NM 87504-1689, Room 433

Make check payable to “Office of Superintendent of Insurance”

For calendar year ending December 31, 2013. Original to be filed no later than April 15, 2014 to avoid a penalty (NMSA 59A-6-4)

Company Name: _________________________________________________________

NM Co. # _____________

Company Address: _________________________________________________________

Class: _____________

NAIC:

_________________________________________________________________

_______________

Contact: _________________________________________________________

Phone/Email: _____________________________________________________

DEDUCTIONS ALLLOWED

1. Gross Premiums

2. Return

3.Political

4. Dividends

5. Premiums

6. Net Premiums

received from

premiums

Subdivisions

paid/credited to

received from

on which the New

policies within the

policyholders

Authorized

Mexico tax is

CLASS

State of New Mexico

companies for

based

reinsurance on

(Column 1 minus

NM risks.

2, 3, 4 & 5).

(19.1) Pvt. Passengers Auto

No Fault

(19.2) Other Pvt. Passenger

Auto Liability

(19.3) Commercial Auto No

Fault

(19.4) Other Commercial

Auto Liability

(21.1) Pvt. Passenger Auto-

Physical Damage

(21.2) Commercial Auto-

Physical Damage

(22) Aircraft (All Perils)

Miscellaneous

1.TOTALS

2. Premium Tax Due (3.003% of line 1)

st

nd

3. Less 1

and 2

quarterly taxes paid (include credit taken)

rd

th

4. Less 3

and 4

quarterly taxes paid (include credit taken)

5. Less year 2013 remaining credit not used in line 3 & 4

6.Net Premium Taxes Due

#78

Total Amount of Check

Check #

The insurance company above named; whose return for PREMIUM TAX is herein above set forth; that they signed the forgoing

Premium Tax returns for and as of the act of said insurance company by authority of its Board of Directors that they have

examined the contents thereof; and that to their best knowledge and belief are true and correct, as disclosed the books of said

insurance company as of December 31, 2013.

NOTARY SEAL

____________________________

President/Authorized Signature

Notary Signature _____________________

My Commission Expires _______________

_____________________________

Subscribed and sworn before me this _____ day of _______, 20___

Secretary/Treasurer/Authorized Signature

Form 303

1

1