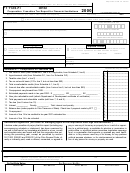

Form Ft 1120fi - Corporation Franchise Tax Report For Financial Institutions - 2007 Page 2

ADVERTISEMENT

2007

Name

Franchise tax I.D.#

Tax year

FT 1120FI

Rev. 10/06

Page 2

Schedule B – Balance Sheet

Include with this report a balance sheet that reflects the books of the taxpayer as of the beginning and end of the taxable year.

Schedule C – Exempted Assets (Net Book Value)

Whole Dollars Only

00

1. Goodwill (attach explanation) .......................................................................................................................

1.

00

2. Abandoned property (attach explanation) ....................................................................................................

2.

00

3. Appreciation (attach explanation) .................................................................................................................

3.

00

4. Investments in production credit associations ............................................................................................

4.

00

5. Other (attach explanation) ............................................................................................................................

5.

00

6. Total exempted assets. Enter here and on Schedule E, line 6. ..................................................................

6.

Schedule D – Apportionment Ratio

(1)

(2)

(3)

Sales Factor – R.C. 5733.056(F)

Ohio

Everywhere

Ratio

1. Receipts from the lease, sublease or rental of real property ...............

2. Receipts from the lease or rental of tangible personal property ..........

3. Interest from loans secured by real property ........................................

4. Interest from loans not secured by real property ..................................

5. Net gains from the sale of loans secured by real property ..................

6. Net gains from the sale of loans not secured by real property ............

7. Interest and fees charged to credit-card holders .................................

8. Net gains from the sale of credit-card receivables ...............................

9. Credit-card issuer’s reimbursement fees ............................................

10. Receipts from merchant discount ........................................................

11. Loan-servicing fees from loans secured by real property ....................

12. Loan-servicing fees from loans not secured by real property ..............

13. Loan-servicing fees for servicing the loans of others ..........................

14. Receipts from services not otherwise apportioned .............................

15. Interest, dividends, net gains and other income from both

investment assets and activities and trading assets and activities ....

(Carry to six

Check method:

Avg. value method

Gross income method

decimals)

16. Certain other receipts ............................................................................

.

÷

=

17. Total. Enter ratio here and on Schedule D-1, line 1, column 1 .............

(Ratio)

Property Factor – R.C. 5733.056(D)

Ohio

Everywhere

18. Real property and tangible personal property owned ..........................

19. Real property and tangible personal property rented x 8 .....................

20. Loans and credit-card receivables .......................................................

.

÷

=

21. Total. Enter ratio here and on Schedule D-1, line 2, column 1 .............

(Ratio)

Note: If the property factor is less than 1.00, please attach to this report a schedule that separately lists the taxpayer’s Ohio and

everywhere cost values at the beginning and the end of the taxpayer’s taxable year for the following assets: (1) buildings and other

depreciable assets, (2) land, (3) credit card receivables, (4) loans to subsidiaries and (5) loans other than loans to subsidiaries.

Payroll Factor – R.C. 5733.056(E)

Ohio

Everywhere

22. Compensation paid to employees. Enter ratio here and on

.

÷

=

Schedule D-1, line 3, column 1 .............................................................

(Ratio)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4