Application For Occupational License - City Of Glasgow

ADVERTISEMENT

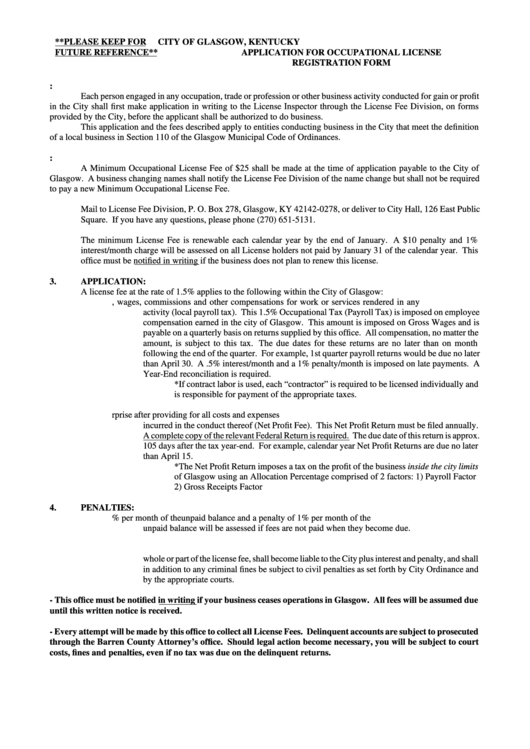

**PLEASE KEEP FOR

CITY OF GLASGOW, KENTUCKY

FUTURE REFERENCE**

APPLICATION FOR OCCUPATIONAL LICENSE

REGISTRATION FORM

1.

PERSONS REQUIRED TO FILE APPLICATION:

Each person engaged in any occupation, trade or profession or other business activity conducted for gain or profit

in the City shall first make application in writing to the License Inspector through the License Fee Division, on forms

provided by the City, before the applicant shall be authorized to do business.

This application and the fees described apply to entities conducting business in the City that meet the definition

of a local business in Section 110 of the Glasgow Municipal Code of Ordinances.

2.

PAYMENT OF MINIMUM OCCUPATIONAL LICENSE FEE:

A Minimum Occupational License Fee of $25 shall be made at the time of application payable to the City of

Glasgow. A business changing names shall notify the License Fee Division of the name change but shall not be required

to pay a new Minimum Occupational License Fee.

Mail to License Fee Division, P. O. Box 278, Glasgow, KY 42142-0278, or deliver to City Hall, 126 East Public

Square. If you have any questions, please phone (270) 651-5131.

The minimum License Fee is renewable each calendar year by the end of January. A $10 penalty and 1%

interest/month charge will be assessed on all License holders not paid by January 31 of the calendar year. This

office must be notified in writing if the business does not plan to renew this license.

3.

APPLICATION:

A license fee at the rate of 1.5% applies to the following within the City of Glasgow:

A.

Salaries, wages, commissions and other compensations for work or services rendered in any

activity (local payroll tax). This 1.5% Occupational Tax (Payroll Tax) is imposed on employee

compensation earned in the city of Glasgow. This amount is imposed on Gross Wages and is

payable on a quarterly basis on returns supplied by this office. All compensation, no matter the

amount, is subject to this tax. The due dates for these returns are no later than on month

following the end of the quarter. For example, 1st quarter payroll returns would be due no later

than April 30. A .5% interest/month and a 1% penalty/month is imposed on late payments. A

Year-End reconciliation is required.

*If contract labor is used, each “contractor” is required to be licensed individually and

is responsible for payment of the appropriate taxes.

B.

Income from the operation of a business or enterprise after providing for all costs and expenses

incurred in the conduct thereof (Net Profit Fee). This Net Profit Return must be filed annually.

A complete copy of the relevant Federal Return is required. The due date of this return is approx.

105 days after the tax year-end. For example, calendar year Net Profit Returns are due no later

than April 15.

*The Net Profit Return imposes a tax on the profit of the business inside the city limits

of Glasgow using an Allocation Percentage comprised of 2 factors: 1) Payroll Factor

2) Gross Receipts Factor

4.

PENALTIES:

A.

Interest at a rate of ½% per month of the unpaid balance and a penalty of 1% per month of the

unpaid balance will be assessed if fees are not paid when they become due.

B.

Any person or persons who shall attempt to do anything whatsoever to avoid the payment of the

whole or part of the license fee, shall become liable to the City plus interest and penalty, and shall

in addition to any criminal fines be subject to civil penalties as set forth by City Ordinance and

by the appropriate courts.

- This office must be notified in writing if your business ceases operations in Glasgow. All fees will be assumed due

until this written notice is received.

- Every attempt will be made by this office to collect all License Fees. Delinquent accounts are subject to prosecuted

through the Barren County Attorney’s office. Should legal action become necessary, you will be subject to court

costs, fines and penalties, even if no tax was due on the delinquent returns.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2