Declaration Of Estimated Tax For Year 2013 - City Of Mason Page 2

ADVERTISEMENT

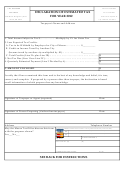

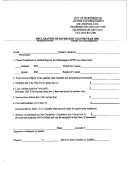

INSTRUCTIONS FOR ESTIMATING TAX

WHO MUST FILE

(a) Every resident of the City of Mason who expects to receive taxable income,

wherever earned, regardless of the city withheld for.

(b) Every non-resident who expects to receive taxable income earned or derived within

the City of Mason from which Mason tax will not be withheld at 1.12%.

WHEN TO FILE

Quarterly installments are due on or before April 15, July 31, October 31, and January 31.

AMOUNT OF ESTIMATED TAX REQUIRED

Taxpayers who are subject to the City of Mason income tax must have ninety percent

(90%) of their current year’s tax liability paid through quarterly estimated payments and

withholding tax by January 31 of the following year. Taxpayers who do not meet these

payment requirements are subject to an underpayment penalty as provided by the Income

Tax Ordinance.

PAYMENT OF ESTIMATED TAX

Make check payable to City of Mason Tax Office or sign the credit card section and

indicate credit card number, expiration date, amount authorized, and your telephone

number(s).

AMENDED DECLARATION OF ESTIMATED TAX

The Declaration of Estimated Tax may be amended at any time, but not later than January

31 of the following year, in order to meet the above payment requirements. It is the

responsibility of the taxpayer to determine the amount of estimated tax due for the year,

file any amendment, and pay the estimated tax.

LINE-BY-LINE INSTRUCTIONS

Line 1: Indicate the estimated Total Income Subject to Tax (income earned while living

or working in Mason) and multiply by the 1.12% tax rate.

Line 2A: Indicate the amount of tax you expect to be withheld by your employer for the

City of Mason (if any).

Line 2B (If you work in another taxing city): Multiply the portion of your Mason-

taxable income that will also be taxed by another city by up to 1.12%.*

* The amount depends on your work city’s tax rate. If your work city’s tax rate is less

than 1.12%, use that city’s percentage to calculate the credit. Otherwise, use 1.12%.

Line 2C: Total credits from lines 2A and 2B.

Line 3: Subtract line 2C from line 1.

Line 4: Divide line 3 by four to calculate the quarterly amount due. The quarterly

payment schedule is below.

2013 Declaration and Return Payment Calendar

April 15, 2013

July 31, 2013

October 31, 2013 January 31, 2014 April 15, 2014

File 2012 Return

Make 2nd

Make 3rd

Make 4th

File 2013 Return

quarterly

quarterly

quarterly

File 2013

File 2014

payment

payment

payment

Declaration with

Declaration with

1/4 payment

1/4 payment

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2