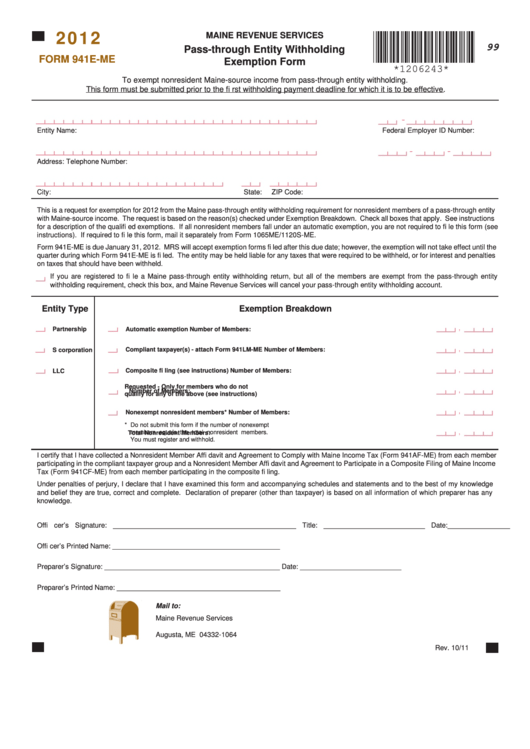

Form 941e-Me - Pass-Through Entity Withholding Exemption - 2012

ADVERTISEMENT

2012

MAINE REVENUE SERVICES

99

Pass-through Entity Withholding

FORM 941E-ME

Exemption Form

*1206243*

To exempt nonresident Maine-source income from pass-through entity withholding.

This form must be submitted prior to the fi rst withholding payment deadline for which it is to be effective.

-

Entity Name:

Federal Employer ID Number:

-

-

Address:

Telephone Number:

City:

State:

ZIP Code:

This is a request for exemption for 2012 from the Maine pass-through entity withholding requirement for nonresident members of a pass-through entity

with Maine-source income. The request is based on the reason(s) checked under Exemption Breakdown. Check all boxes that apply. See instructions

for a description of the qualifi ed exemptions. If all nonresident members fall under an automatic exemption, you are not required to fi le this form (see

instructions). If required to fi le this form, mail it separately from Form 1065ME/1120S-ME.

Form 941E-ME is due January 31, 2012. MRS will accept exemption forms fi led after this due date; however, the exemption will not take effect until the

quarter during which Form 941E-ME is fi led. The entity may be held liable for any taxes that were required to be withheld, or for interest and penalties

on taxes that should have been withheld.

If you are registered to fi le a Maine pass-through entity withholding return, but all of the members are exempt from the pass-through entity

withholding requirement, check this box, and Maine Revenue Services will cancel your pass-through entity withholding account.

Entity Type

Exemption Breakdown

,

Partnership

Automatic exemption

Number of Members:

,

Compliant taxpayer(s) - attach Form 941LM-ME

Number of Members:

S corporation

,

Composite fi ling (see instructions)

Number of Members:

LLC

Requested - Only for members who do not

,

Number of Members:

qualify for any of the above (see instructions)

,

Nonexempt nonresident members*

Number of Members:

* Do not submit this form if the number of nonexempt

,

members equals the total nonresident members.

Total Nonresident Members:

You must register and withhold.

I certify that I have collected a Nonresident Member Affi davit and Agreement to Comply with Maine Income Tax (Form 941AF-ME) from each member

participating in the compliant taxpayer group and a Nonresident Member Affi davit and Agreement to Participate in a Composite Filing of Maine Income

Tax (Form 941CF-ME) from each member participating in the composite fi ling.

Under penalties of perjury, I declare that I have examined this form and accompanying schedules and statements and to the best of my knowledge

and belief they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any

knowledge.

Offi cer’s Signature: _______________________________________________

Title: __________________________ Date:________________

Offi cer’s Printed Name: ___________________________________________

Preparer’s Signature: _____________________________________________

Date: __________________________

Preparer’s Printed Name: __________________________________________

Mail to:

Maine Revenue Services

P.O. Box 1064

Augusta, ME 04332-1064

Rev. 10/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1