Reset Form

Print Form

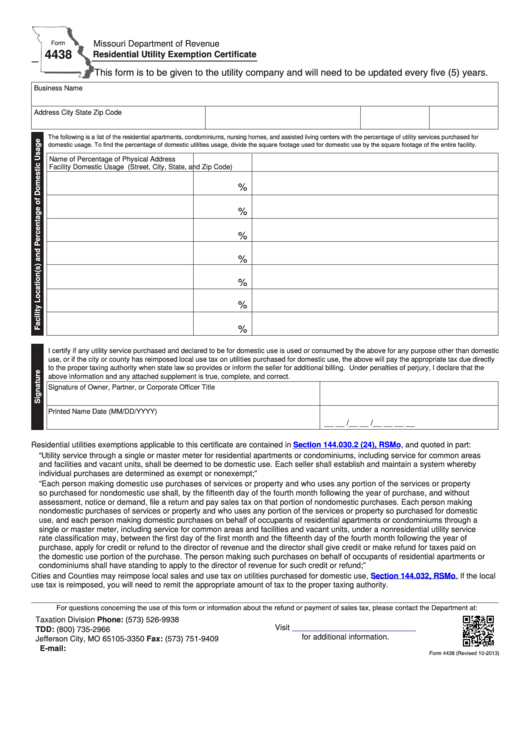

Form

Missouri Department of Revenue

4438

Residential Utility Exemption Certificate

This form is to be given to the utility company and will need to be updated every five (5) years.

Business Name

Address

City

State

Zip Code

The following is a list of the residential apartments, condominiums, nursing homes, and assisted living centers with the percentage of utility services purchased for

domestic usage. To find the percentage of domestic utilities usage, divide the square footage used for domestic use by the square footage of the entire facility.

Name of

Percentage of

Physical Address

Facility

Domestic Usage

(Street, City, State, and Zip Code)

%

%

%

%

%

%

%

I certify if any utility service purchased and declared to be for domestic use is used or consumed by the above for any purpose other than domestic

use, or if the city or county has reimposed local use tax on utilities purchased for domestic use, the above will pay the appropriate tax due directly

to the proper taxing authority when state law so provides or inform the seller for additional billing. Under penalties of perjury, I declare that the

above information and any attached supplement is true, complete, and correct.

Signature of Owner, Partner, or Corporate Officer

Title

Printed Name

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

RSMo, and quoted in part:

Residential utilities exemptions applicable to this certificate are contained in

Section 144.030.2 (24),

“Utility service through a single or master meter for residential apartments or condominiums, including service for common areas

and facilities and vacant units, shall be deemed to be domestic use. Each seller shall establish and maintain a system whereby

individual purchases are determined as exempt or nonexempt;”

“Each person making domestic use purchases of services or property and who uses any portion of the services or property

so purchased for nondomestic use shall, by the fifteenth day of the fourth month following the year of purchase, and without

assessment, notice or demand, file a return and pay sales tax on that portion of nondomestic purchases. Each person making

nondomestic purchases of services or property and who uses any portion of the services or property so purchased for domestic

use, and each person making domestic purchases on behalf of occupants of residential apartments or condominiums through a

single or master meter, including service for common areas and facilities and vacant units, under a nonresidential utility service

rate classification may, between the first day of the first month and the fifteenth day of the fourth month following the year of

purchase, apply for credit or refund to the director of revenue and the director shall give credit or make refund for taxes paid on

the domestic use portion of the purchase. The person making such purchases on behalf of occupants of residential apartments or

condominiums shall have standing to apply to the director of revenue for such credit or refund;”

Cities and Counties may reimpose local sales and use tax on utilities purchased for domestic use,

Section 144.032,

RSMo. If the local

use tax is reimposed, you will need to remit the appropriate amount of tax to the proper taxing authority.

For questions concerning the use of this form or information about the refund or payment of sales tax, please contact the Department at:

Phone: (573) 526-9938

Taxation Division

Visit

P.O. Box 3350

TDD: (800) 735-2966

Jefferson City, MO 65105-3350

Fax: (573) 751-9409

for additional information.

E-mail: salesrefund@dor.mo.gov

Form 4438 (Revised 10-2013)

1

1