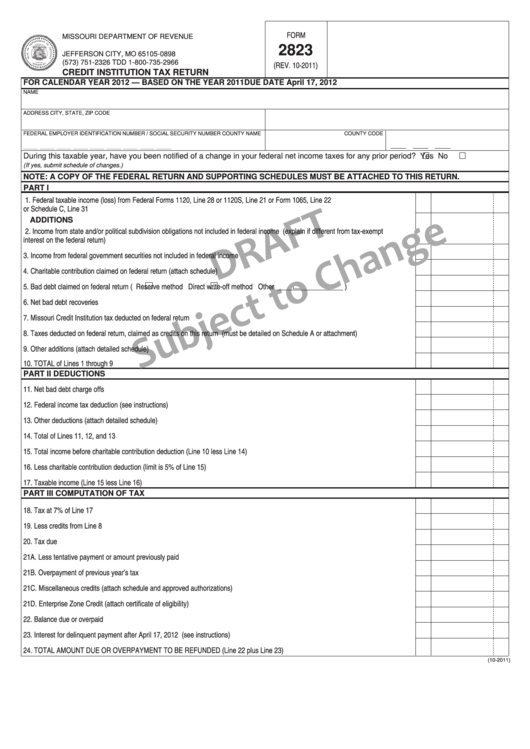

Form 2823 - Credit Institution Tax Return - 2011

ADVERTISEMENT

FORM

MISSOURI DEPARTMENT OF REVENUE

P.O. BOX 898

2823

JEFFERSON CITY, MO 65105‑0898

(573) 751‑2326

TDD 1‑800‑735‑2966

(REV. 10-2011)

CREDIT INSTITUTION TAX RETURN

FOR CALENDAR YEAR 2012 — BASED ON THE YEAR 2011

DUE DATE April 17, 2012

NAME

ADDRESS

CITY, STATE, ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER / SOCIAL SECURITY NUMBER

COUNTY NAME

COUNTY CODE

___ ___ ___ ___ ___ ___ ___ ___ ___

During this taxable year, have you been notified of a change in your federal net income taxes for any prior period?

Yes

No

(If yes, submit schedule of changes.)

NOTE: A COPY OF THE FEDERAL RETURN AND SUPPORTING SCHEDULES MUST BE ATTACHED TO THIS RETURN.

PART I

1. Federal taxable income (loss) from Federal Forms 1120, Line 28 or 1120S, Line 21 or Form 1065, Line 22

or Schedule C, Line 31 ..........................................................................................................................................................................

1

ADDITIONS

2. Income from state and/or political subdivision obligations not included in federal income (explain if different from tax-exempt

interest on the federal return) ................................................................................................................................................................

2

3. Income from federal government securities not included in federal income .........................................................................................

3

4. Charitable contribution claimed on federal return (attach schedule) .....................................................................................................

4

5. Bad debt claimed on federal return (

Reserve method

Direct write-off method

Other ___________________ ) ........

5

6. Net bad debt recoveries ........................................................................................................................................................................

6

7. Missouri Credit Institution tax deducted on federal return .....................................................................................................................

7

8. Taxes deducted on federal return, claimed as credits on this return (must be detailed on Schedule A or attachment) ......................

8

9. Other additions (attach detailed schedule) ............................................................................................................................................

9

10. TOTAL of Lines 1 through 9 ..................................................................................................................................................................

10

PART II

DEDUCTIONS

11. Net bad debt charge offs .......................................................................................................................................................................

11

12. Federal income tax deduction (see instructions) ...................................................................................................................................

12

13. Other deductions (attach detailed schedule) .........................................................................................................................................

13

14. Total of Lines 11, 12, and 13 .................................................................................................................................................................

14

15. Total income before charitable contribution deduction (Line 10 less Line 14) ......................................................................................

15

16. Less charitable contribution deduction (limit is 5% of Line 15) ..............................................................................................................

16

17. Taxable income (Line 15 less Line 16)..................................................................................................................................................

17

PART III

COMPUTATION OF TAX

18. Tax at 7% of Line 17 .............................................................................................................................................................................

18

19. Less credits from Line 8 ........................................................................................................................................................................

19

20. Tax due .................................................................................................................................................................................................

20

21A. Less tentative payment or amount previously paid ...............................................................................................................................

21A

21B. Overpayment of previous year’s tax ......................................................................................................................................................

21B

21C. Miscellaneous credits (attach schedule and approved authorizations) .................................................................................................

21C

21D. Enterprise Zone Credit (attach certificate of eligibility) ..........................................................................................................................

21D

22. Balance due or overpaid .......................................................................................................................................................................

22

23. Interest for delinquent payment after April 17, 2012 (see instructions) ................................................................................................

23

24. TOTAL AMOUNT DUE OR OVERPAYMENT TO BE REFUNDED (Line 22 plus Line 23) ..................................................................

24

(10‑2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2