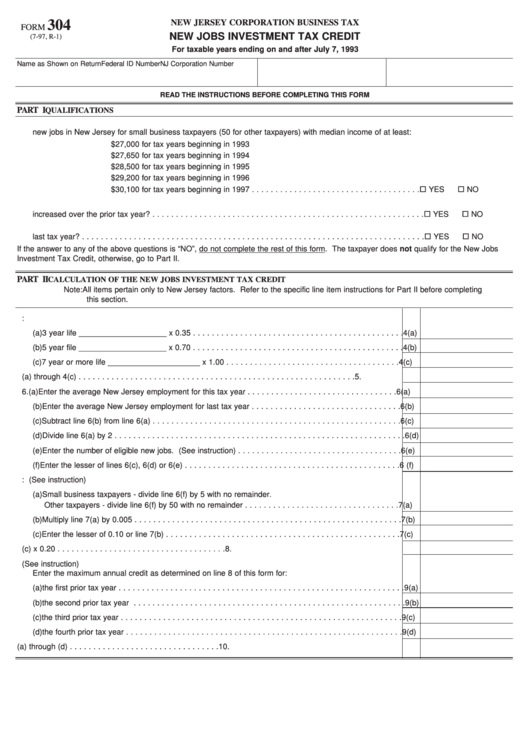

304

NEW JERSEY CORPORATION BUSINESS TAX

FORM

NEW JOBS INVESTMENT TAX CREDIT

(7-97, R-1)

For taxable years ending on and after July 7, 1993

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

PART I

QUALIFICATIONS

1. Has the taxpayer invested in property purchased for new or expanded business facilities that created at least 5

new jobs in New Jersey for small business taxpayers (50 for other taxpayers) with median income of at least:

$27,000 for tax years beginning in 1993

$27,650 for tax years beginning in 1994

$28,500 for tax years beginning in 1995

$29,200 for tax years beginning in 1996

$30,100 for tax years beginning in 1997 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ YES

¨ NO

2. Has the average book value of all real and tangible personal property in New Jersey of the taxpayer

increased over the prior tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ YES

¨ NO

3. Is the average employment of the taxpayer in New Jersey in the current tax year greater than that of the

last tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ YES

¨ NO

If the answer to any of the above questions is “NO”, do not complete the rest of this form. The taxpayer does not qualify for the New Jobs

Investment Tax Credit, otherwise, go to Part II.

PART II

CALCULATION OF THE NEW JOBS INVESTMENT TAX CREDIT

Note: All items pertain only to New Jersey factors. Refer to the specific line item instructions for Part II before completing

this section.

4. Enter the amounts of the qualified investments made during the current tax year:

(a) 3 year life ____________________ x 0.35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4(a)

(b) 5 year file ____________________ x 0.70 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4(b)

(c) 7 year or more life _____________________ x 1.00 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4(c)

5. Add lines 4(a) through 4(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. (a) Enter the average New Jersey employment for this tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6(a)

(b) Enter the average New Jersey employment for last tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6(b)

(c) Subtract line 6(b) from line 6(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6(c)

(d) Divide line 6(a) by 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6(d)

(e) Enter the number of eligible new jobs. (See instruction) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6(e)

(f) Enter the lesser of lines 6(c), 6(d) or 6(e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 (f)

7. New Jobs Factor: (See instruction)

(a) Small business taxpayers - divide line 6(f) by 5 with no remainder.

Other taxpayers - divide line 6(f) by 50 with no remainder . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7(a)

(b) Multiply line 7(a) by 0.005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7(b)

(c) Enter the lesser of 0.10 or line 7(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7(c)

8. Maximum annual credit - Multiply line 5 x line 7(c) x 0.20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Prior year qualified investment (See instruction)

Enter the maximum annual credit as determined on line 8 of this form for:

(a) the first prior tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9(a)

(b) the second prior tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9(b)

(c) the third prior tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9(c)

(d) the fourth prior tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9(d)

10. Aggregate annual credit - Add line 8 and lines 9(a) through (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

1

1 2

2