Form M-941 - Employer'S Return Of Income Taxes Withheld

ADVERTISEMENT

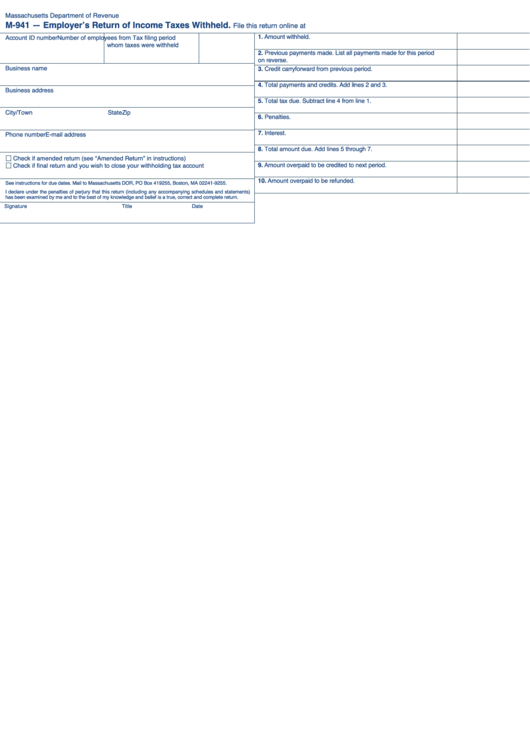

Massachusetts Department of Revenue

M-941 — Employer’s Return of Income Taxes Withheld.

File this return online at mass.gov/masstaxconnect.

1. Amount withheld.

Account ID number

Number of employees from

Tax filing period

whom taxes were withheld

2. Previous payments made. List all payments made for this period

on reverse.

Business name

3. Credit carryforward from previous period.

4. Total payments and credits. Add lines 2 and 3.

Business address

5. Total tax due. Subtract line 4 from line 1.

City/Town

State

Zip

6. Penalties.

7. Interest.

Phone number

E-mail address

8. Total amount due. Add lines 5 through 7.

Check if amended return (see “Amended Return” in instructions)

9. Amount overpaid to be credited to next period.

Check if final return and you wish to close your withholding tax account

10. Amount overpaid to be refunded.

See instructions for due dates. Mail to Massachusetts DOR, PO Box 419255, Boston, MA 02241-9255.

I declare under the penalties of perjury that this return (including any accompanying schedules and statements)

has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2