Page 3

Legal Name (First 10 Characters)

Federal Employer ID Number

Important

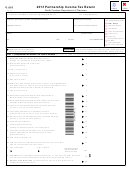

D-403

If more than three partners, include separate

Web-Fill

schedule for additional partners.

10-13

Part 3.

A. Partners’ Shares of Income, Adjustments, Tax Credits, and Other Items

Complete Lines 1 through 8 for all partners.

B. Computation of North Carolina Taxable Income for Nonresident Partners

Complete Lines 9 through 17 for all nonresident partners.

C. Computation of Tax Due for Nonresident Partners on Whose Behalf the Partnership Pays the Tax

Complete Lines 18 through 20.

A

Attach other pages if needed.

Partner 1

Partner 2

Partner 3

1.

Identifying Number

2.

Name

3.

Address

%

%

%

4. Partner’s share percentage

5.

Type of partner

(Ex: Ind., Corp., Part.)

6.

Additions to income (loss)

(To Form NC K-1, Line 2)

7.

Deductions from income (loss)

(To Form NC K-1, Line 3)

8.

Share of Tax Credits

(To Form NC K-1, Line 4)

B

9.

Guaranteed payments to

nonresident partners applicable

to income on Part 1, Line 8

10.

Percentage from Line 4 times

amount on Part 1, Line 8

11.

Add Lines 9 and 10

%

%

%

12.

Apportionment percentage from

Part 2, Line 15

13.

Multiply Line 11 by Line 12

14.

Guaranteed payments to

nonresident partners applicable

to income on Part 1, Line 9

15.

Percentage from Line 4 times

amount on Part 1, Line 9

16.

Separately stated items of

income attributable to

nonresident partners

17.

North Carolina taxable income

(Add Lines 13, 14, 15, and 16)

C

18.

Tax Due

(See Tax Rate Schedule on Page 4)

19.

Tax credits allocated to

nonresident partners from

Line 8 above

20.

Net Tax Due

(Line 18 minus Line 19)

Important: The Partnership must provide each Partner an NC K-1 for Form D-403 or other information necessary for the Partner to prepare the appropriate North Carolina Tax Return.

1

1 2

2 3

3 4

4 5

5