Form W-3 - Reconciliation Of Tax Withheld From Wages

ADVERTISEMENT

GENERAL INFORMATION

On or before February 28 of each year, each employer must file a withholding reconciliation. Copies of all

W-2 forms applicable to the reconciliation must be attached. All W-2's must furnish the name, address, social

security number, gross wages, city tax withheld, name of city for which tax was withheld, and any other

compensation paid to the individual. If copies of the W-2 forms are not available, each employer must provide a

listing of all employees subject to tax. The listing shall require the same type of information as is required of the

W-2 form.

Any individual(s) or business entity compensating individuals on a commission or contract labor basis must

furnish copies of the 1099 or appropriate earnings statement on or before February 28 of each year. All 1099's or

earnings statements shall require the same type of information as is required of the W-2 forms as stated above.

The front of the Form W-3 must show a breakdown of all withholding payments made either quarterly or

monthly in the boxes provided. Please keep Part 3 for your records. The completed W-3 form (Parts 1 and 2) and all

attachments must be submitted to the Department of Taxation, 106 E. Spring Street, St. Marys, Ohio 45885 on or

before February 28 of each year. Any questions in completing the Form W-3 should be referred to the Department

of Taxation.

OVERPYAMENTS - It is recommended that you adjust the next remittance by the amount of the overpayment.

Refunds can take 90 days or more to process. *An over-withheld W-2 cannot be used to offset an under-withheld

W-2. Credit for an over-withheld W-2 can only be used by the employee.

TAX RATES

Anna - 1.75%

Botkins - 1.5%

Osgood - 1.0%

Minster - 1.5%

New Bremen - 1.5%

St.Marys - 1.5%

North Star – 0.5%

New Knoxville - 1.5%

Russia - 1.5%

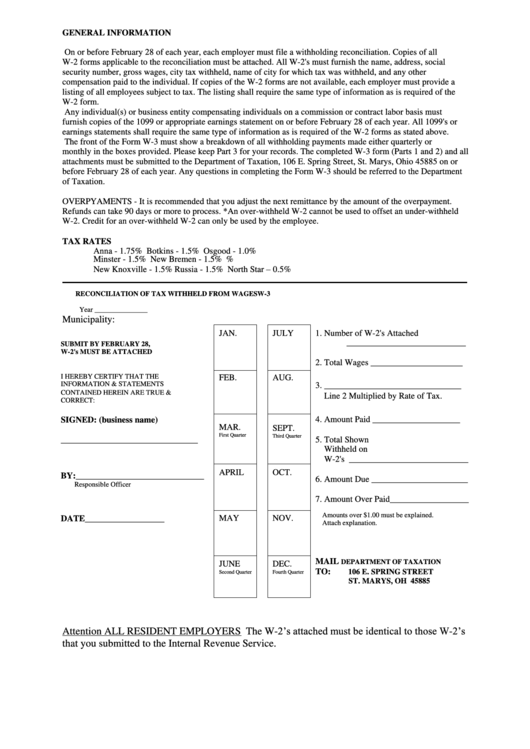

RECONCILIATION OF TAX WITHHELD FROM WAGES W-3

Year _______________

Municipality:

JAN.

JULY

1. Number of W-2's Attached

___________________________

SUBMIT BY FEBRUARY 28,

W-2's MUST BE ATTACHED

2. Total Wages _____________________

I HEREBY CERTIFY THAT THE

FEB.

AUG.

INFORMATION & STATEMENTS

3. _______________________________

CONTAINED HEREIN ARE TRUE &

Line 2 Multiplied by Rate of Tax.

CORRECT:

SIGNED: (business name)

4. Amount Paid ____________________

MAR.

SEPT.

First Quarter

Third Quarter

_______________________________

5. Total Shown

Withheld on

W-2's ___________________________

APRIL

OCT.

BY:_____________________________

6. Amount Due ______________________

Responsible Officer

7. Amount Over Paid__________________

Amounts over $1.00 must be explained.

DATE__________________

MAY

NOV.

Attach explanation.

MAIL

DEPARTMENT OF TAXATION

JUNE

DEC.

TO:

106 E. SPRING STREET

Second Quarter

Fourth Quarter

ST. MARYS, OH 45885

Attention ALL RESIDENT EMPLOYERS The W-2’s attached must be identical to those W-2’s

that you submitted to the Internal Revenue Service.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1