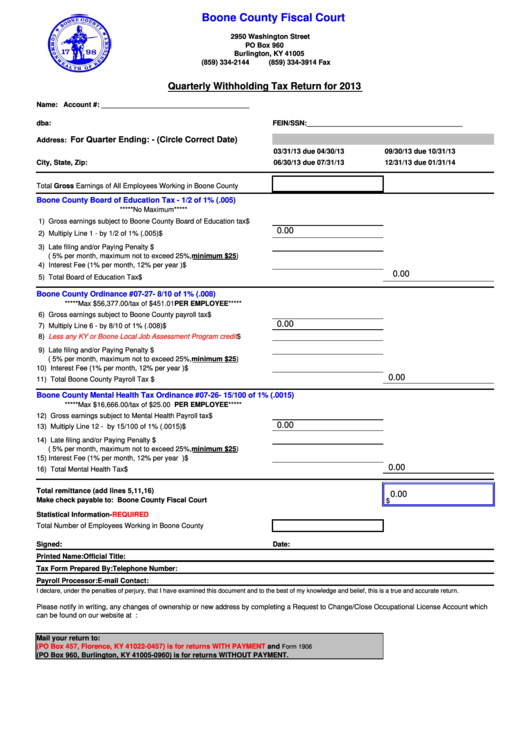

Boone County Fiscal Court

2950 Washington Street

PO Box 960

Burlington, KY 41005

(859) 334-2144

(859) 334-3914 Fax

Quarterly Withholding Tax Return for 2013

Name:

Account #: ______________________________________

dba:

FEIN/SSN:________________________________________

For Quarter Ending: - (Circle Correct Date)

Address:

03/31/13 due 04/30/13

09/30/13 due 10/31/13

City, State, Zip:

06/30/13 due 07/31/13

12/31/13 due 01/31/14

Total Gross Earnings of All Employees Working in Boone County

Boone County Board of Education Tax - 1/2 of 1% (.005)

*****No Maximum*****

1) Gross earnings subject to Boone County Board of Education tax

$

0.00

2) Multiply Line 1 - by 1/2 of 1% (.005)

$

3) Late filing and/or Paying Penalty

$

( 5% per month, maximum not to exceed 25%,minimum $25)

4) Interest Fee (1% per month, 12% per year )

$

0.00

5) Total Board of Education Tax

$

Boone County Ordinance #07-27- 8/10 of 1% (.008)

*****Max $56,377.00/tax of $451.01 PER EMPLOYEE*****

6) Gross earnings subject to Boone County payroll tax

$

0.00

7) Multiply Line 6 - by 8/10 of 1% (.008)

$

8)

Less any KY or Boone Local Job Assessment Program credit

$

9) Late filing and/or Paying Penalty

$

( 5% per month, maximum not to exceed 25%,minimum $25)

10) Interest Fee (1% per month, 12% per year )

$

0.00

11) Total Boone County Payroll Tax

$

Boone County Mental Health Tax Ordinance #07-26- 15/100 of 1% (.0015)

*****Max $16,666.00/tax of $25.00 PER EMPLOYEE*****

12) Gross earnings subject to Mental Health Payroll tax

$

0.00

13) Multiply Line 12 - by 15/100 of 1% (.0015)

$

14) Late filing and/or Paying Penalty

$

( 5% per month, maximum not to exceed 25%,minimum $25)

15) Interest Fee (1% per month, 12% per year )

$

0.00

16) Total Mental Health Tax

$

Total remittance (add lines 5,11,16)

0.00

Make check payable to: Boone County Fiscal Court

$

Statistical

Information-REQUIRED

Total Number of Employees Working in Boone County

Signed:

Date:

Printed Name:

Official Title:

Tax Form Prepared By:

Telephone Number:

Payroll Processor:

E-mail Contact:

I declare, under the penalties of perjury, that I have examined this document and to the best of my knowledge and belief, this is a true and accurate return.

Please notify in writing, any changes of ownership or new address by completing a Request to Change/Close Occupational License Account which

can be found on our website at If you have any questions please call 859-334-2144 or email:

Mail your return to:

(PO Box 457, Florence, KY 41022-0457) is for returns WITH PAYMENT

and

Form 1906

(PO Box 960, Burlington, KY 41005-0960) is for returns WITHOUT PAYMENT.

1

1