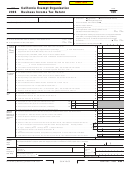

Schedule A Cost of Goods Sold and/or Operations. Method of inventory valuation (specify) _______________________________________________

00

1 Inventory at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

� Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

00

3 Cost of labor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

� a Additional IRC Section 263A costs. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�a

00

00

b Other costs. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�b

00

5 Total. Add line 1 through line 4b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

00

7 Cost of goods sold and/or operations. Subtract line 6 from line 5. Enter here and on Side 2, Part I, line 2 . . . . . . . . . . . . .

7

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to this organization? Yes No

Schedule B Tax Credits. Do not claim the New Jobs Credit on Schedule B.

00

1 Enter credit name__________________________code no.__________ . . . . . .

1

00

� Enter credit name__________________________code no.__________ . . . . . .

�

3 Enter credit name__________________________code no.__________ . . . . . .

3

00

� Total. Add line 1 through line 3. If claiming more than 3 credits, enter the total of all claimed credits,

00

except New Jobs Credit, on line 4. Enter here and on Side 1, line 11c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

Schedule K Add-On Taxes or Recapture of Tax. See instructions.

00

1

Interest computation under the look-back method for completed long-term contracts. Attach form FTB 3834 . . . . . . . .

1

00

�

Interest on tax attributable to installment: a Sales of certain timeshares or residential lots. . . . . . . . . . . . . . . . . . . . .

�a

00

b Method for non-dealer installment obligations . . . . . . . . . . . . . . . . . . . .

�b

00

3

IRC Section 197(f)(9)(B)(ii) election to recognize gain on the disposition of intangibles. . . . . . . . . . . . . . . . . . . . . . . . .

3

00

�

Credit recapture. Credit name___________________________________________. . . . . . . . . . . . . . . . . . . . . . . . . . .

�

5

Total. Combine the amounts on line 1 through line 4. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

Schedule R Apportionment Formula Worksheet

Is this organization electing the Alternate Method – Single-Sales Factor Formula? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

If “Yes,” skip Part A and complete Part B. If “No,” complete Part A and skip Part B.

Part A. Standard Method – Three Factor Formula. Complete this part only if the corporation uses the three-factor formula. (The three-factor formula includes

the double-weighted sales factor.)

Use only for unrelated trade or business amounts

(a) Total within and

(b) Total within California

(c) Percent within

outside California

California (b) ÷ (a)

1

Property factor: See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

Payroll factor: Wages and other compensation of employees . . . . . . . . . . . . . . . . . . . . . . .

3

Sales factor: Gross sales and/or receipts less returns and allowances . . . . . . . . . . . . . . . .

�

Multiply the factor on line 3, column (c) by 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Total percentage: Add the percentages in column (c), line 1, line 2, and line 4. . . . . . . . . .

6

Average apportionment percentage: Divide the factor on line 5 by 4 and enter the

result here and on Form 109, Side 1, line 2. See instructions for exceptions. . . . . . . . . . . .

Part B. Alternate Method – Single-Sales Factor Formula. Complete this part only if the corporation elects the single-sales factor formula.

This is an irrevocable annual election.

Use only for unrelated trade or business amounts

(a) Total within and

(b) Total within California

(c) Percent within

outside California

California (b) ÷ (a)

1

Total Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

Apportionment percentage. Divide total sales column (b) by total sales column (a) and

enter the result here and on Form 109, Side 1, line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule C Rental Income from Real Property and Personal Property Leased with Real Property

For rental income from debt-financed property, use Schedule D, R&TC Section 23701g, Section 23701i, and Section 23701n organizations. See instructions for exceptions.

1 Description of property

� Rent received

3 Percentage of rent attributable

or accrued

to personal property

%

%

%

� Complete if any item in column 3 is more than 50%, or for any item

5 Complete if any item in column 3 is more than 10%, but not more than 50%

if the rent is determined on the basis of profit or income

(a) Deductions directly connected

(b) Income includible, column 2

(a) Gross income reportable,

(b) Deductions directly connected with

(c) Net income includible, column 5(a)

(attach schedule)

less column 4(a)

column 2 x column 3

personal property (attach schedule)

less column 5(b)

Add columns 4(b) and column 5(c). Enter here and on Side 2, Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 109

2011 Side 3

C1

3643113

1

1 2

2 3

3 4

4 5

5