2011

MARYLAND

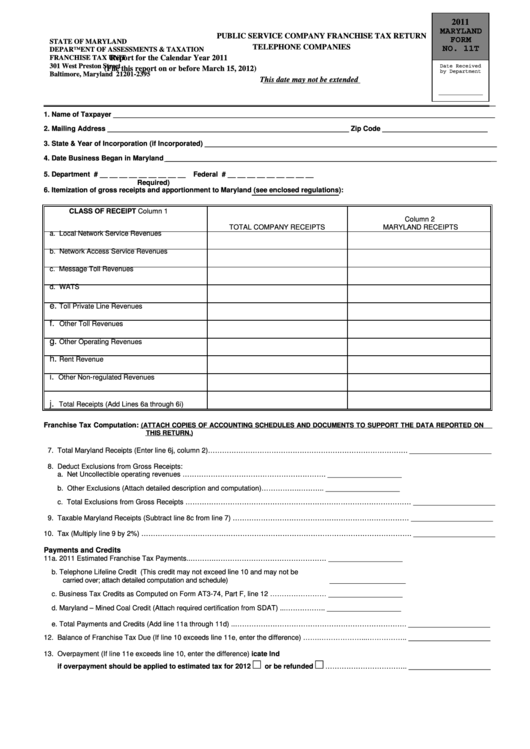

PUBLIC SERVICE COMPANY FRANCHISE TAX RETURN

FORM

STATE OF MARYLAND

TELEPHONE COMPANIES

NO. 11T

DEPARTMENT OF ASSESSMENTS & TAXATION

Report for the Calendar Year 2011

FRANCHISE TAX UNIT

301 West Preston Street

Date Received

(File this report on or before March 15, 2012)

by Department

Baltimore, Maryland 21201-2395

This date may not be extended

______________

____________________________________________________________________________________________________________________

1. Name of Taxpayer __________________________________________________________________________________________________

2. Mailing Address ______________________________________________________________

Zip Code ___________________________

3. State & Year of Incorporation (if Incorporated) ___________________________________________________________________________

4. Date Business Began in Maryland _____________________________________________________________________________________

5. Department I.D. # __ __ __ __ __ __ __ __ __

Federal I.D. # __ __ __ __ __ __ __ __ __

Required)

6. Itemization of gross receipts and apportionment to Maryland (see enclosed regulations):

CLASS OF RECEIPT

Column 1

Column 2

TOTAL COMPANY RECEIPTS

MARYLAND RECEIPTS

a. Local Network Service Revenues

b. Network Access Service Revenues

c. Message Toll Revenues

d. WATS

e.

Toll Private Line Revenues

f.

Other Toll Revenues

g.

Other Operating Revenues

h.

Rent Revenue

i.

Other Non-regulated Revenues

j.

Total Receipts (Add Lines 6a through 6i)

Franchise Tax Computation:

(ATTACH COPIES OF ACCOUNTING SCHEDULES AND DOCUMENTS TO SUPPORT THE DATA REPORTED ON

THIS RETURN.)

7. Total Maryland Receipts (Enter line 6j, column 2)…………………………………………………………………………. _____________________

8. Deduct Exclusions from Gross Receipts:

a. Net Uncollectible operating revenues ……………………………………………………. ___________________

b. Other Exclusions (Attach detailed description and computation)…………….……….. ___________________

c. Total Exclusions from Gross Receipts …………………………………………………………………………………… _____________________

9. Taxable Maryland Receipts (Subtract line 8c from line 7) ………………………………………………………………… _____________________

10. Tax (Multiply line 9 by 2%) ……………………………………………………………………………………………………. _____________________

Payments and Credits

11a. 2011 Estimated Franchise Tax Payments..……….………………………………………… ___________________

b. Telephone Lifeline Credit (This credit may not exceed line 10 and may not be

carried over; attach detailed computation and schedule)

____________________

c. Business Tax Credits as Computed on Form AT3-74, Part F, line 12 …………………… ___________________

d. Maryland – Mined Coal Credit (Attach required certification from SDAT) ...…………….. ___________________

e. Total Payments and Credits (Add line 11a through 11d) ..………………………………………………………………. _____________________

12. Balance of Franchise Tax Due (If line 10 exceeds line 11e, enter the difference) …….………………...…………….. _____________________

13. Overpayment (If line 11e exceeds line 10, enter the difference)

Ind

icate

□

□

if overpayment should be applied to estimated tax for 2012

or be refunded

…………………………….. _____________________

1

1 2

2