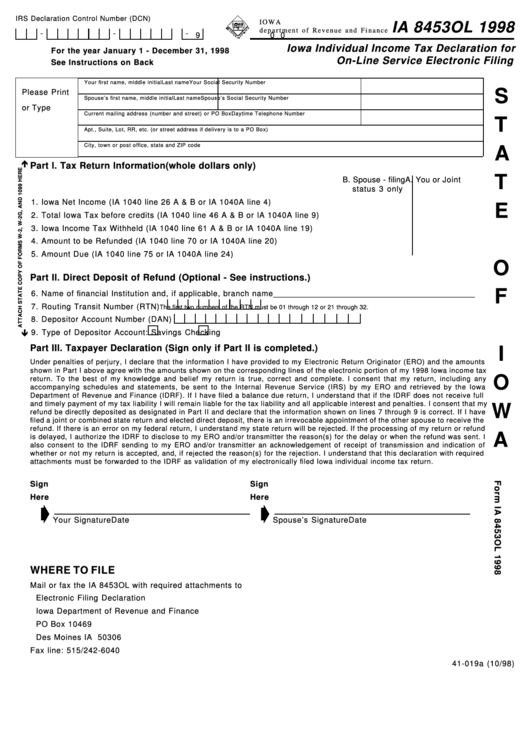

IRS Declaration Control Number (DCN)

I OWA

IA 8453OL 1998

d e p a r t m e n t o f R eve n u e a n d F i n a n c e

-

-

-

0 0

9

Iowa Individual Income Tax Declaration for

For the year January 1 - December 31, 1998

On-Line Service Electronic Filing

See Instructions on Back

Your first name, middle initial

Last name

Your Social Security Number

S

Please Print

Spouse’s first name, middle initial

Last name

Spouse’s Social Security Number

or Type

Current mailing address (number and street) or PO Box

Daytime Telephone Number

T

Apt., Suite, Lot, RR, etc. (or street address if delivery is to a PO Box)

City, town or post office, state and ZIP code

A

Part I. Tax Return Information

(whole dollars only)

T

B. Spouse - filing

A. You or Joint

status 3 only

1. Iowa Net Income (IA 1040 line 26 A & B or IA 1040A line 4) ................................. 1B ________ .00 1A _________ .00

E

2. Total Iowa Tax before credits (IA 1040 line 46 A & B or IA 1040A line 9) ............ 2B ________ .00 2A _________ .00

3. Iowa Income Tax Withheld (IA 1040 line 61 A & B or IA 1040A line 19) ............... 3B ________ .00 3A _________ .00

4. Amount to be Refunded (IA 1040 line 70 or IA 1040A line 20) .............................................................. 4 __________ .00

5. Amount Due (IA 1040 line 75 or IA 1040A line 24) .................................................................................. 5 __________ .00

O

Part II. Direct Deposit of Refund (Optional - See instructions.)

F

6. Name of financial Institution and, if applicable, branch name ______________________________________________

7. Routing Transit Number (RTN)

The first two numbers of the RTN must be 01 through 12 or 21 through 32.

8. Depositor Account Number (DAN)

9. Type of Depositor Account:

Savings

Checking

Part III. Taxpayer Declaration (Sign only if Part II is completed.)

I

Under penalties of perjury, I declare that the information I have provided to my Electronic Return Originator (ERO) and the amounts

shown in Part I above agree with the amounts shown on the corresponding lines of the electronic portion of my 1998 Iowa income tax

O

return. To the best of my knowledge and belief my return is true, correct and complete. I consent that my return, including any

accompanying schedules and statements, be sent to the Internal Revenue Service (IRS) by my ERO and retrieved by the Iowa

Department of Revenue and Finance (IDRF). If I have filed a balance due return, I understand that if the IDRF does not receive full

and timely payment of my tax liability I will remain liable for the tax liability and all applicable interest and penalties. I consent that my

W

refund be directly deposited as designated in Par t II and declare that the information shown on lines 7 through 9 is correct. If I have

filed a joint or combined state return and elected direct deposit, there is an irrevocable appointment of the other spouse to receive the

refund. If there is an error on my federal return, I understand my state return will be rejected. If the processing of my return or refund

A

is delayed, I authorize the IDRF to disclose to my ERO and/or transmitter the reason(s) for the delay or when the refund was sent. I

also consent to the IDRF sending to my ERO and/or transmitter an acknowledgement of receipt of transmission and indication of

whether or not my return is accepted, and, if rejected the reason(s) for the rejection. I understand that this declaration with required

attachments must be forwarded to the IDRF as validation of my electronically filed Iowa individual income tax return.

Sign

Sign

Here

Here

Your Signature

Date

Spouse’s Signature

Date

WHERE TO FILE

Mail or fax the IA 8453OL with required attachments to

Electronic Filing Declaration

Iowa Department of Revenue and Finance

PO Box 10469

Des Moines IA 50306

Fax line: 515/242-6040

41-019a (10/98)

1

1