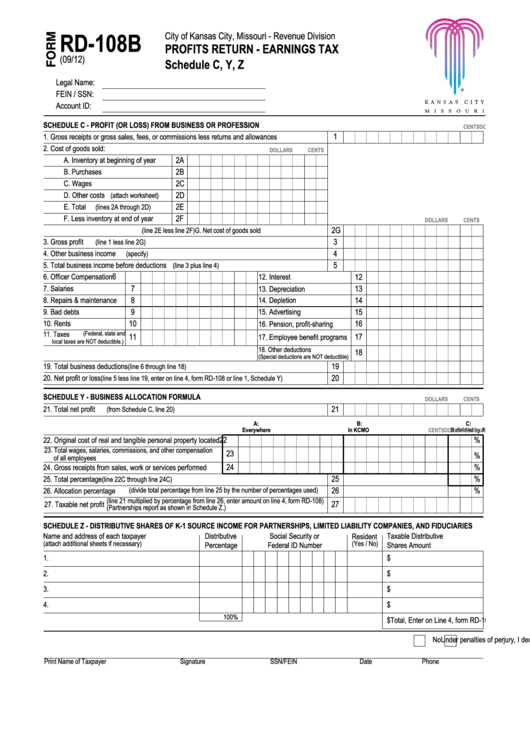

Form Rd-108b - Profits Return - Earnings Tax Schedule C, Y, Z

ADVERTISEMENT

City of Kansas City, Missouri - Revenue Division

RD-108B

PROFITS RETURN - EARNINGS TAX

(09/12)

Schedule C, Y, Z

Legal Name:

FEIN / SSN:

Account ID:

SCHEDULE C - PROFIT (OR LOSS) FROM BUSINESS OR PROFESSION

DOLLARS

CENTS

1. Gross receipts or gross sales, fees, or commissions less returns and allowances

1

2. Cost of goods sold:

DOLLARS

CENTS

2A

A. Inventory at beginning of year

2B

B. Purchases

C. Wages

2C

2D

D. Other costs

(attach worksheet)

2E

E. Total

(lines 2A through 2D)

2F

F. Less inventory at end of year

DOLLARS

CENTS

2G

G. Net cost of goods sold

(line 2E less line 2F)

3

3. Gross profit

(line 1 less line 2G)

4

4. Other business income

(specify)

5. Total business income before deductions

5

(line 3 plus line 4)

6

6. Officer Compensation

12. Interest

12

7

7. Salaries

13

13. Depreciation

8. Repairs & maintenance

8

14. Depletion

14

9

9. Bad debts

15. Advertising

15

10

16

10. Rents

16. Pension, profit-sharing

11. Taxes

(Federal, state and

11

17

17. Employee benefit programs

local taxes are NOT deductible.)

18. Other deductions

18

(Special deductions are NOT deductible)

19

19. Total business deductions

(line 6 through line 18)

20

20. Net profit or loss

(line 5 less line 19, enter on line 4, form RD-108 or line 1, Schedule Y)

SCHEDULE Y - BUSINESS ALLOCATION FORMULA

DOLLARS

CENTS

21. Total net profit

21

(from Schedule C, line 20)

A:

B:

C:

Everywhere

DOLLARS

CENTS

In KCMO

DOLLARS

CENTS

B divided by A

22

%

22. Original cost of real and tangible personal property located

23. Total wages, salaries, commissions, and other compensation

23

%

of all employees

24

%

24. Gross receipts from sales, work or services performed

25

%

25. Total percentage

(line 22C through line 24C)

(divide total percentage from line 25 by the number of percentages used)

26

%

26. Allocation percentage

(line 21 multiplied by percentage from line 26, enter amount on line 4, form RD-108)

27

27. Taxable net profit

(Partnerships report as shown in Schedule Z.)

SCHEDULE Z - DISTRIBUTIVE SHARES OF K-1 SOURCE INCOME FOR PARTNERSHIPS, LIMITED LIABILITY COMPANIES, AND FIDUCIARIES

Name and address of each taxpayer

Distributive

Social Security or

Taxable Distributive

Resident

(attach additional sheets if necessary)

(Yes / No)

Percentage

Federal ID Number

Shares Amount

1.

$

2.

$

3.

$

4.

$

100%

Total, Enter on Line 4, form RD-108

$

Under penalties of perjury, I declare this schedule to be true and correct.

Yes

No

Print Name of Taxpayer

Signature

SSN/FEIN

Date

Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1