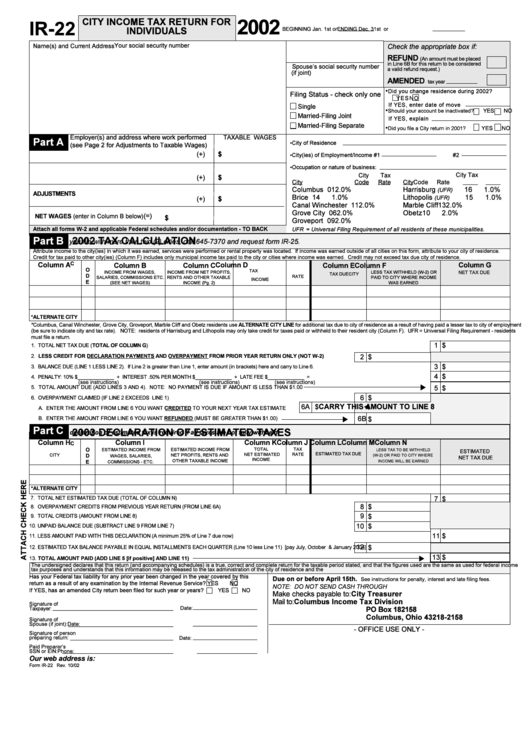

Form Ir-22 - City Income Tax Return For Individuals - 2002

ADVERTISEMENT

2002

CITY INCOME TAX RETURN FOR

IR-22

INDIVIDUALS

Your social security number

Name(s) and Current Address

Check the appropriate box if:

REFUND

Spouse’s social security number

(if joint)

AMENDED

•

Did you change residence during 2002?

Filing Status - check only one

YES

N O

If YES, enter date of move

Single

•

YES

NO

Married-Filing Joint

If YES, explain

Married-Filing Separate

•

YES

NO

Employer(s) and address where work performed

TAXABLE WAGES

Part A

A

•City of Residence

(see Page 2 for Adjustments to Taxable Wages)

(+)

$

•City(ies) of Employment/Income #1

#2

•Occupation or nature of business:

City

Tax

City

Tax

(+)

$

City

Code

Rate

City

Code

Rate

Columbus

01

2.0%

Harrisburg

16

1.0%

(UFR)

ADJUSTMENTS

Brice

14

1.0%

Lithopolis

15

1.0%

(UFR)

(+)

$

Canal Winchester

11

2.0%

Marble Cliff

13

2.0%

Grove City

06

2.0%

Obetz

10

2.0%

(=)

NET WAGES (enter in Column B below)

$

Groveport

09

2.0%

Attach all forms W-2 and applicable Federal schedules and/or documentation - TO BACK

UFR = Universal Filing Requirement of all residents of these municipalities.

Part B

2002 TAX CALCULATION

If you file with more than two (2) cities, call 645-7370 and request form IR-25.

C

Column A

Column D

Column G

Column B

Column C

Column E

Column F

O

TAX

INCOME FROM WAGES,

INCOME FROM NET PROFITS,

LESS TAX WITHHELD (W-2) OR

NET TAX DUE

CITY

TOTAL NET TAXABLE

TAX DUE

D

RATE

SALARIES, COMMISSIONS ETC.

RENTS AND OTHER TAXABLE

PAID TO CITY WHERE INCOME

INCOME

E

(SEE NET WAGES)

INCOME (Pg. 2)

WAS EARNED

*ALTERNATE CITY

ALTERNATE CITY LINE

1

$

TOTAL OF COLUMN G ......................................................................................................................................................................................................................

LESS CREDIT FOR DECLARATION PAYMENTS AND OVERPAYMENT FROM PRIOR YEAR RETURN ONLY (NOT W-2).................

2

$

3

$

.............................................................................................

4

$

..............................................................................................

u

5

$

6

$

...........................................................................................................................................

CARRY THIS AMOUNT TO LINE 8

6A $

t

CREDITED

......

6B

$

REFUNDED

u

Part C

2003 DECLARATION OF ESTIMATED TAXES

A declaration of estimated tax is required if all taxes are not fully withheld.

Column H

Column I

Column J

Column K

Column L

Column M

Column N

C

O

TOTAL

TAX

ESTIMATED INCOME FROM

ESTIMATED INCOME FROM

LESS TAX TO BE WITHHELD

ESTIMATED TAX DUE

NET ESTIMATED

RATE

CITY

D

NET PROFITS, RENTS AND

(W-2) OR PAID TO CITY WHERE

WAGES, SALARIES,

INCOME

OTHER TAXABLE INCOME

INCOME WILL BE EARNED

E

COMMISSIONS - ETC.

*ALTERNATE CITY

...............................................................................................................................................................................................

7

$

8

$

...................................................................................................

9

$

...................................................................................................................................................................

10

$

......................................................................................................................................

11

$

........................................................................................................................................................

12

$

13

$

u

TOTAL AMOUNT PAID (ADD LINE 5 [if positive] AND LINE 11)

Has your Federal tax liability for any prior year been changed in the year covered by this

Due on or before April 15th.

return as a result of any examination by the Internal Revenue Service?

YES

NO

NOTE: DO NOT SEND CASH THROUGH U.S. MAIL.

If YES, has an amended City return been filed for such year or years?

YES

NO

Make checks payable to:

City Treasurer

Mail to:

Columbus Income Tax Division

PO Box 182158

Columbus, Ohio 43218-2158

- OFFICE USE ONLY -

Our web address is:

Form IR-22 Rev. 10/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2