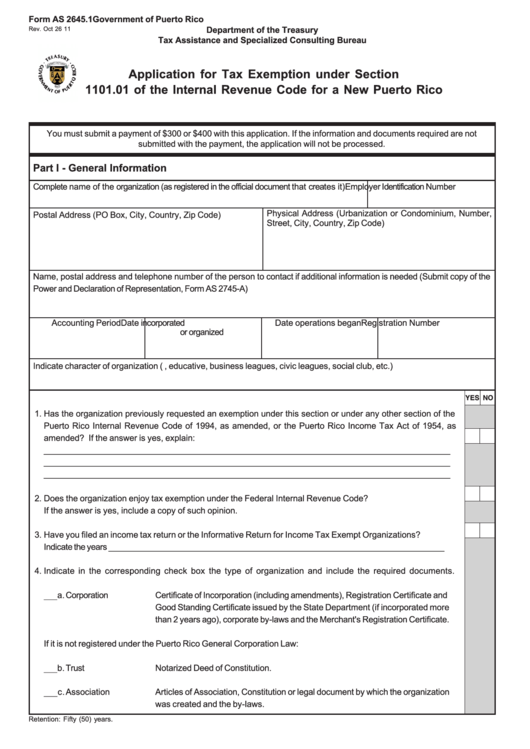

Form As 2645.1 - Application For Tax Exemption Under Section 1101.01 Of The Internal Revenue Code For A New Puerto Rico

ADVERTISEMENT

Form AS 2645.1

Government of Puerto Rico

Department of the Treasury

Rev. Oct 26 11

Tax Assistance and Specialized Consulting Bureau

Application for Tax Exemption under Section

1101.01 of the Internal Revenue Code for a New Puerto Rico

You must submit a payment of $300 or $400 with this application. If the information and documents required are not

submitted with the payment, the application will not be processed.

Part I - General Information

Complete name of the organization (as registered in the official document that creates it)

Employer Identification Number

Physical Address (Urbanization or Condominium, Number,

Postal Address (PO Box, City, Country, Zip Code)

Street, City, Country, Zip Code)

Name, postal address and telephone number of the person to contact if additional information is needed (Submit copy of the

Power and Declaration of Representation, Form AS 2745-A)

Accounting Period

Date incorporated

Date operations began

Registration Number

or organized

Indicate character of organization (i.e. charitable, educative, business leagues, civic leagues, social club, etc.)

YES

NO

1.

Has the organization previously requested an exemption under this section or under any other section of the

Puerto Rico Internal Revenue Code of 1994, as amended, or the Puerto Rico Income Tax Act of 1954, as

amended? If the answer is yes, explain:

_______________________________________________________________________________________________

________________________________________________________________________________________________

_______________________________________________________________________________________________

2.

Does the organization enjoy tax exemption under the Federal Internal Revenue Code? ...................................

If the answer is yes, include a copy of such opinion.

3.

Have you filed an income tax return or the Informative Return for Income Tax Exempt Organizations? ..............

Indicate the years __________________________________________________________________________

4.

Indicate in the corresponding check box the type of organization and include the required documents.

Corporation

Certificate of Incorporation (including amendments), Registration Certificate and

___a.

Good Standing Certificate issued by the State Department (if incorporated more

than 2 years ago), corporate by-laws and the Merchant's Registration Certificate.

If it is not registered under the Puerto Rico General Corporation Law:

___b.

Trust

Notarized Deed of Constitution.

Association

Articles of Association, Constitution or legal document by which the organization

___c.

was created and the by-laws.

Retention: Fifty (50) years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5