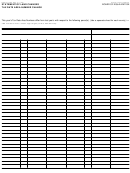

BOE-100-B (S2F) REV. 18 (6-08)

SCHEDULE A: INFORMATION ON ACQUIRED LEGAL ENTITY

Complete this schedule if you answered YES to question 1 on page 1 (S1)

Complete ONE Schedule A for EACH entity acquired

Please provide the following information for the acquired legal entity:

NAME OF THE ACQUIRED LEGAL ENTITY

DATE OWNERSHIP CONTROL WAS OBTAINED

STATE OR FEDERAL IDENTIFICATION NUMBER

MAILING ADDRESS (city, state, and zip code)

CONTACT PERSON

TELEPHONE NUMBER

(

)

Please answer ALL the following questions, as applicable.

YES

NO

1. Was the transfer of ownership interests in the acquired entity between spouses or registered domestic partners? If NO,

proceed to question 2. If YES, complete question 2, then proceed to items 5 and 6.

2. Was the change in ownership control merely a change in the method of holding title such as the transfer of a partnership to

a corporation, a corporation to a trust, etc., or vice versa? AND did the proportionate ownership interests remain exactly

the same before and after the change? If NO, proceed to question 3. If YES, complete question 3, then proceed to

items 5 and 6.

3. Identify the following information regarding nontaxable reorganization:

a. Was the change in control a nontaxable reorganization under section 368 of the Internal Revenue Code? If NO,

complete questions 3b and 3c, then proceed to items 6 and 7. If YES, proceed to question 3b.

b. Was the change in control a nontaxable reorganization under California statutes? If NO, complete question 3c, then

proceed to items 6 and 7. If YES, proceed to question 3c.

c. Was the change in control a nontaxable reorganization where all of the corporations involved were members of an

affiliated group, both before and after the date of the change in control? If NO, proceed to items 6 and 7. If YES, and

yes to both 3a and 3b, complete item 4, then proceed to items 5 and 6.

4. Provide the following information regarding common owner:

NAME OF THE COMMON OWNER

STATE OR FEDERAL IDENTIFICATION NUMBER

MAILING ADDRESS (city, state, and zip code)

CONTACT PERSON

TELEPHONE NUMBER

(

)

5.

Provide a description of the transfer.

(Continued on reverse)

1

1 2

2 3

3 4

4 5

5 6

6