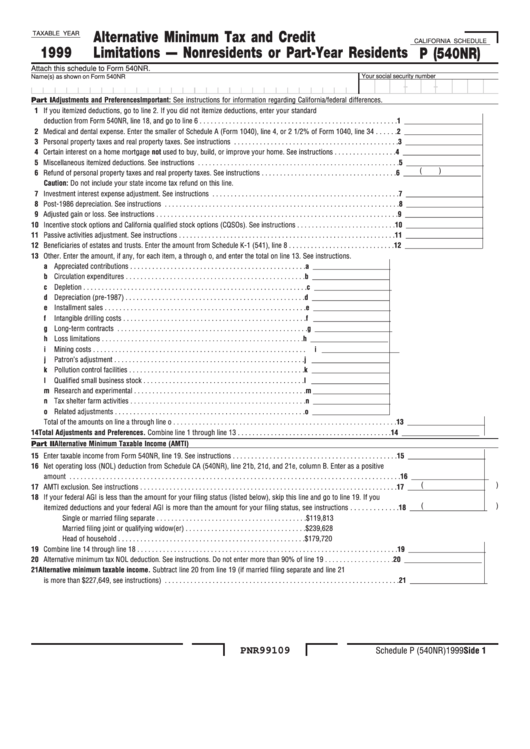

California Schedule P (540nr) - Alternative Minimum Tax And Credit Limitations - Nonresidents Or Part-Year Residents - 1999

ADVERTISEMENT

Alternative Minimum Tax and Credit

TAXABLE YEAR

CALIFORNIA SCHEDULE

1999

Limitations — Nonresidents or Part-Year Residents

P (540NR)

Attach this schedule to Form 540NR.

Name(s) as shown on Form 540NR

Your social security number

-

-

Part I

Adjustments and Preferences Important: See instructions for information regarding California/federal differences.

1 If you itemized deductions, go to line 2. If you did not itemize deductions, enter your standard

deduction from Form 540NR, line 18, and go to line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 _____________________

2 Medical and dental expense. Enter the smaller of Schedule A (Form 1040), line 4, or 2 1/2% of Form 1040, line 34 . . . . . .

2 _____________________

3 Personal property taxes and real property taxes. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 _____________________

4 Certain interest on a home mortgage not used to buy, build, or improve your home. See instructions . . . . . . . . . . . . . . . . .

4 _____________________

5 Miscellaneous itemized deductions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 _____________________

(

)

6 Refund of personal property taxes and real property taxes. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 _____________________

Caution: Do not include your state income tax refund on this line.

7 Investment interest expense adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 _____________________

8 Post-1986 depreciation. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 _____________________

9 Adjusted gain or loss. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 _____________________

10 Incentive stock options and California qualified stock options (CQSOs). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 _____________________

11 Passive activities adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 _____________________

12 Beneficiaries of estates and trusts. Enter the amount from Schedule K-1 (541), line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 _____________________

13 Other. Enter the amount, if any, for each item, a through o, and enter the total on line 13. See instructions.

a Appreciated contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a _____________________

b Circulation expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b _____________________

c Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c _____________________

d Depreciation (pre-1987) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d _____________________

e Installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e _____________________

f

Intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f _____________________

g Long-term contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

g _____________________

h Loss limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

h _____________________

i

Mining costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i _____________________

j

Patron’s adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

j _____________________

k Pollution control facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

k _____________________

l

Qualified small business stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

l _____________________

m Research and experimental . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

m _____________________

n Tax shelter farm activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

n _____________________

o Related adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

o _____________________

Total of the amounts on line a through line o . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 _____________________

14 Total Adjustments and Preferences. Combine line 1 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 _____________________

Part II Alternative Minimum Taxable Income (AMTI)

15 Enter taxable income from Form 540NR, line 19. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 _____________________

16 Net operating loss (NOL) deduction from Schedule CA (540NR), line 21b, 21d, and 21e, column B. Enter as a positive

amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 _____________________

(

)

17 AMTI exclusion. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 _____________________

18 If your federal AGI is less than the amount for your filing status (listed below), skip this line and go to line 19. If you

(

)

itemized deductions and your federal AGI is more than the amount for your filing status, see instructions . . . . . . . . . . . . . 18 _____________________

Single or married filing separate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $119,813

Married filing joint or qualifying widow(er) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $239,628

Head of household . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $179,720

19 Combine line 14 through line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 _____________________

20 Alternative minimum tax NOL deduction. See instructions. Do not enter more than 90% of line 19 . . . . . . . . . . . . . . . . . . . 20 _____________________

21 Alternative minimum taxable income. Subtract line 20 from line 19 (if married filing separate and line 21

is more than $227,649, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 _____________________

PNR99109

Schedule P (540NR) 1999 Side 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3