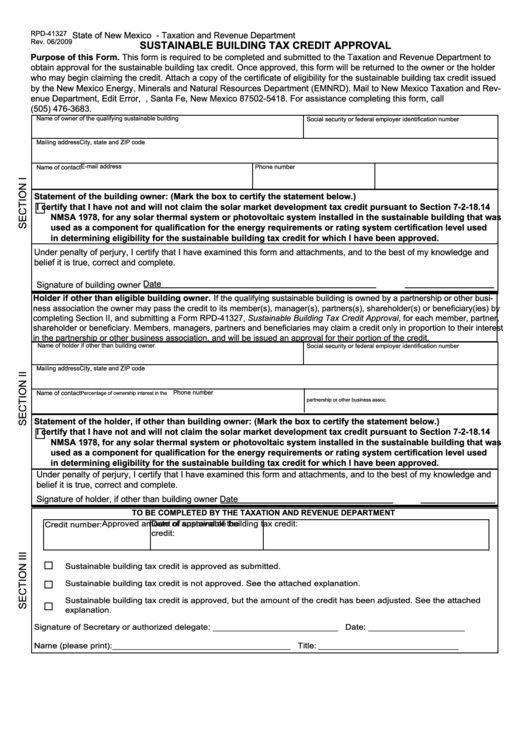

Form Rpd-41327 - Sustainable Building Tax Credit Approval

ADVERTISEMENT

RPD-41327

State of New Mexico - Taxation and Revenue Department

Rev. 06/2009

SUSTAINABLE BUILDING TAX CREDIT APPROVAL

Purpose of this Form. This form is required to be completed and submitted to the Taxation and Revenue Department to

obtain approval for the sustainable building tax credit. Once approved, this form will be returned to the owner or the holder

who may begin claiming the credit. Attach a copy of the certificate of eligibility for the sustainable building tax credit issued

by the New Mexico Energy, Minerals and Natural Resources Department (EMNRD). Mail to New Mexico Taxation and Rev-

enue Department, Edit Error, P.O. Box 5418, Santa Fe, New Mexico 87502-5418. For assistance completing this form, call

(505) 476-3683.

Name of owner of the qualifying sustainable building

Social security or federal employer identification number

Mailing address

City, state and ZIP code

E-mail address

Phone number

Name of contact

Statement of the building owner: (Mark the box to certify the statement below.)

I certify that I have not and will not claim the solar market development tax credit pursuant to Section 7-2-18.14

NMSA 1978, for any solar thermal system or photovoltaic system installed in the sustainable building that was

used as a component for qualification for the energy requirements or rating system certification level used

in determining eligibility for the sustainable building tax credit for which I have been approved.

Under penalty of perjury, I certify that I have examined this form and attachments, and to the best of my knowledge and

belief it is true, correct and complete.

Date

Signature of building owner

Holder if other than eligible building owner. If the qualifying sustainable building is owned by a partnership or other busi-

ness association the owner may pass the credit to its member(s), manager(s), partners(s), shareholder(s) or beneficiary(ies) by

completing Section II, and submitting a Form RPD-41327, Sustainable Building Tax Credit Approval, for each member, partner,

shareholder or beneficiary. Members, managers, partners and beneficiaries may claim a credit only in proportion to their interest

in the partnership or other business association, and will be issued an approval for their portion of the credit.

Name of holder if other than building owner

Social security or federal employer identification number

Mailing address

City, state and ZIP code

Phone number

Name of contact

Percentage of ownership interest in the

partnership or other business assoc.

Statement of the holder, if other than building owner: (Mark the box to certify the statement below.)

I certify that I have not and will not claim the solar market development tax credit pursuant to Section 7-2-18.14

NMSA 1978, for any solar thermal system or photovoltaic system installed in the sustainable building that was

used as a component for qualification for the energy requirements or rating system certification level used

in determining eligibility for the sustainable building tax credit for which I have been approved.

Under penalty of perjury, I certify that I have examined this form and attachments, and to the best of my knowledge and

belief it is true, correct and complete.

Signature of holder, if other than building owner

Date

TO BE COMPLETED BY THE TAXATION AND REVENUE DEPARTMENT

Date of approval of the

Approved amount of sustainable building tax credit:

Credit number:

credit:

Sustainable building tax credit is approved as submitted.

Sustainable building tax credit is not approved. See the attached explanation.

Sustainable building tax credit is approved, but the amount of the credit has been adjusted. See the attached

explanation.

Signature of Secretary or authorized delegate: __________________________

Date: ____________________

Name (please print):_____________________________________

Title: _____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1