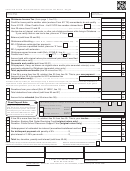

2007 Form 511NR

Page 3

Name(s) shown on Form 511NR

Your Social

Security Number

Oklahoma Additions

See instructions for details on

Schedule 511NR-A

qualifications and required enclosures.

federal amount

oklahoma amount

Reset A

BACK TO PAGE 1

00

00

1

State and municipal bond interest . . . . . . . . . . . . . . . . . .

00

00

2

Lump sum distributions

. . . . .

(not included in your Federal AGI)

00

00

Federal net operating loss . . . . . . . . . . . . . . . . . . . . . . .

3

4

Recapture depletion claimed on a lease bonus or

00

00

add back of excess Federal depletion . . . . . . . . . . . . . . .

00

00

Expenses incurred to provide Okla. child care programs

5

Recapture of contributions to Oklahoma 529 College

6

00

00

Savings Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Miscellaneous: Other additions

7

00

00

(describe ______________________)

Enter as a positive number

8

Total additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

0

0

(add lines 1-7, enter total here and on line 20 of Form 511NR)

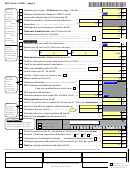

Oklahoma Subtractions

See instructions for details on

Schedule 511NR-B

qualifications and required enclosures.

federal amount

oklahoma amount

Reset B

BACK TO PAGE 1

00

00

Interest on U.S. government obligations . . . . . . . . . . . . .

1

00

00

Taxable Social Security

. . . . . . . . . .

(from Form 511NR, line 14)

2

00

00

Civil service retirement in lieu of social security . . . . . . . .

3

-

Retirement

00

00

Taxpayer

Spouse

Claim Number:

00

00

Military Retirement (see instructions for limitation) . . . . . .

4

00

00

Oklahoma government or Federal civil service retirement

5

00

00

Other retirement income . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

00

U.S. Railroad Retirement Board Benefits . . . . . . . . . . . . .

7

00

00

Additional depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

00

Oklahoma net operating loss . . . . . . . . . . . . . . . . . . . . . .

9

00

00

Exempt tribal income . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

00

Gains from the sale of exempt government obligations . .

11

00

Nonresident military wages (enclose W-2) . . . . . . . . . . . .

12

00

00

Oklahoma Capital Gain Deduction

.

(Enclose Form 561NR)

13

00

00

Miscellaneous: Other subtractions . . . . . . . . . . . . . . . . . .

14

(enter number in box for the type of deduction

)

Press here to select Type of Deduction

Total subtractions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

15

0

0

(add lines 1-14, enter total here and on line 22 of Form 511NR)

Oklahoma Adjustments

See instructions for details on

Schedule 511NR-C

qualifications and required enclosures.

Reset C

BACK TO PAGE 2

00

1

Partial military pay exclusion (not retirement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

2

Qualifying disability deduction (residents and part-year residents only) . . . . . . . . . . . . .

00

3

Political contribution (limited to $100 single or $200 joint) . . . . . . . . . . . . . . . . . . . . . . .

00

4

Interest qualifying for exclusion (limited to $100 single or $200 joint) . . . . . . . . . . . . .

00

5

Qualified adoption expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

6

Contributions to an Oklahoma 529 College Savings Plan account(s) . . . . . . . . . . . . . . .

00

7

Miscellaneous: Other adjustments

)

(enter number in box for the type of deduction

Press here to select Type of Deduction

Total Adjustments (add lines 1-7, enter total here and on line 26 of Form 511NR) . . .

8

00

0

1

1 2

2 3

3 4

4 5

5