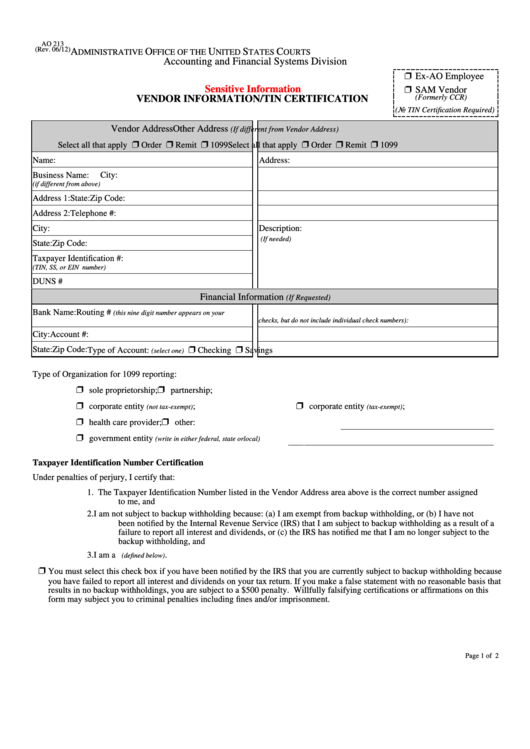

AO 213

(Rev. 06/12)

A

O

U

S

C

DMINISTRATIVE

FFICE OF THE

NITED

TATES

OURTS

Accounting and Financial Systems Division

’ Ex-AO Employee

Sensitive Information

’ SAM Vendor

(Formerly CCR)

VENDOR INFORMATION/TIN CERTIFICATION

(No TIN Certification Required)

Vendor Address

Other Address

(If different from Vendor Address)

’

’

’

’

’

’

Select all that apply

Order

Remit

1099

Select all that apply

Order

Remit

1099

Name:

Address:

Business Name:

City:

(if different from above)

Address 1:

State:

Zip Code:

Address 2:

Telephone #:

City:

Description:

(If needed)

State:

Zip Code:

Taxpayer Identification #:

(TIN, SS, or EIN number)

DUNS #

Financial Information

(If Requested)

Bank Name:

Routing #

(this nine digit number appears on your

checks, but do not include individual check numbers):

City:

Account #:

’

’

State:

Zip Code:

Type of Account:

Checking

Savings

(select one)

Type of Organization for 1099 reporting:

’

’

sole proprietorship;

partnership;

’

’

corporate entity

;

corporate entity

;

(not tax-exempt)

(tax-exempt)

’

’

health care provider;

other:

’

government entity

(write in either federal, state or local)

Taxpayer Identification Number Certification

Under penalties of perjury, I certify that:

1.

The Taxpayer Identification Number listed in the Vendor Address area above is the correct number assigned

to me, and

2.

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not

been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a

failure to report all interest and dividends, or (c) the IRS has notified me that I am no longer subject to the

backup withholding, and

3.

I am a U.S. citizen or other U.S. person

.

(defined below)

’

You must select this check box if you have been notified by the IRS that you are currently subject to backup withholding because

you have failed to report all interest and dividends on your tax return. If you make a false statement with no reasonable basis that

results in no backup withholdings, you are subject to a $500 penalty. Willfully falsifying certifications or affirmations on this

form may subject you to criminal penalties including fines and/or imprisonment.

Page 1 of 2

1

1 2

2